This is a guest post, by Bruce Sharp.

Ontario Electricity – The Liberals Giveth and Taketh AwayThe big energy splash in the Ontario Government’s September 12 throne speech was rebating the provincial portion of the HST to certain electricity users. This group will include mainly voters and is estimated to cost about $ 1 billion per year, with the cost being born by provincial taxpayers. In a

September 14 Linkedin post, I commented on the merits of the move.

Another electricity move announced that same day was the expansion of the Industrial Conservation Initiative (ICI), otherwise known as the Global Adjustment (GA) Class A.

Ontario’s GA is the electricity market mechanism for collecting and allocating above-market generation and conservation and demand management costs. Prior to 2011, there was a single GA class, with all consumers paying for GA costs based on a uniform, postage-stamp rate. Starting in 2011, we had two classes: A and B, with the classes’ shares of GA costs determined in different ways. This program did not initially have a name but at some point was dubbed the Industrial Conservation Initiative. Class A now pays significantly less than they would have, had we still had one GA class. The result is a transfer of costs from Class A to Class B, i.e. a cost decrease for Class A’s mostly large industrial consumers and a cost increase for Class B -- residential and most other Ontario electricity consumers.

In an

April 14 Linkedin post, I provided an update on that cost transfer. Given the recent news, I thought I’d provide another update, estimate the additional transfer that will occur as a result of the expansion of Class A and look at the economics of the initiative.

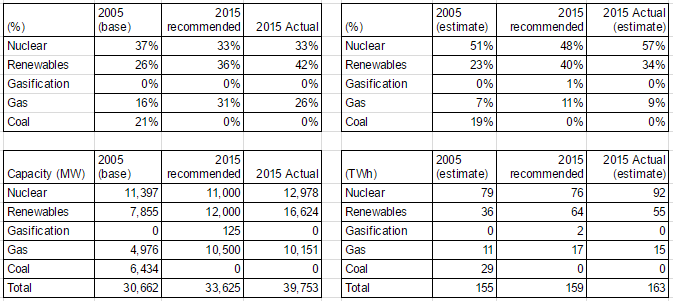

For the period of October 2015 through September 2016, total GA costs were $12.1 billion. If there had still been a single GA class, the uniform rate would have been $ 86.20/MWh.

With the two classes, there was a cost transfer from Class A to B of $ 940 million. Class A paid an average of $ 52.50/MWh or 39% less than they would have had we still had a single GA class. Class B -- by virtue of its larger total energy consumption -- paid $ 94.60/MWh or 9.7% more. For the residential consumer with losses-inclusive, annual consumption of 9.5 MWh, that represents an added cost (inclusive of HST) of $ 90/year.

The expansion of Class A will take place either July 1, 2017 or July 1, 2018. One source I’ve spoken to says the government will want to do this sooner rather than later. It will likely involve removing baffling restrictions to the 3 – 5 MW eligibility and a reduction of the overall average monthly demand threshold to 1 MW. A thousand businesses are to be newly eligible,

The result will be an additional cost transfer – from the new Class A consumers to the remaining Class B consumers.

How much will it be?

.png)