You purchase a full 9-unit container of energy .

The 3 men who deliver it pour out 2 units out while lecturing on consumption.

They imply you should make more yourself as they leave.

They imply you should make more yourself as they leave.

A couple of months have passed since I last posted to the blog. This may be due to writer's block, or a lack of ambition - or maybe I was wisely waiting until I had something nice to say!

With growing knowledge, and curiosity, I seem to muddle all little issues into the broad themes I deem important - and not only for energy. In this post I'll touch on metrics from 2017 the reader may be looking to this blog to find, with hopes of connecting the data to bigger issues.

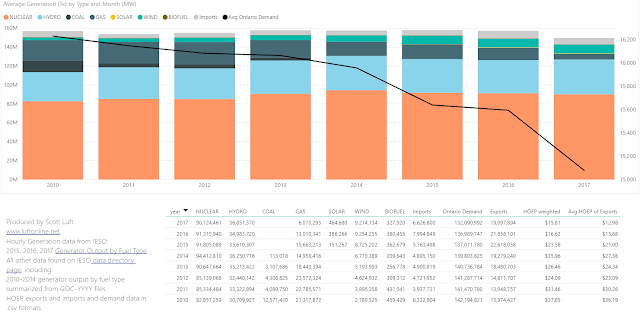

There are many possible headlines from an annual analysis:

- electricity "demand", as reported by the system operator was down, to levels not seen in decades

- supply generated from fossil fuels (natural gas) was sharply down too, and again to levels probably not seen in over over half a century

- prices for consumers on regulated price plans were sharply down in 2017 due to legislation and consequent debt (the [un]Fair Power Plan), but,

- total costs for supply declined in 2017, although average unit cost was up slightly (as demand declined more)

- nuclear supply was down as one unit (Darlington 2) was out of service for the entire year due to refurbishment, but the units remaining online largely took up the slack as Bruce Power had record output, as did the set of 9 units at Ontario Power Generation which operated during 2017, and

- for the first year since the system operator reported on their system's wind output, in 2006, it reported a decline (albeit a very slight one)

I do wish, in this post, to combine commentary to statistics to demonstrate very good figures from one perspective can have bad implications from a broader perspective. This is particularly important to note as the reasons rates didn't rise sharply in 2017 aren't sustainable.

Ontario's 2017 electricity data is now mostly in (although never perfect), but it will remain inadequate until the system operator (the IESO) develops a capability for reporting on generation within distribution networks, and actual consumption - both at, and behind, the meter.

I was active on Twitter January 1st reporting on last year's data. The basis of my initial commentary was a data tool I developed with Microft's Power BI (some explanation of the tool is on the data site I created in 2017). This data set is called "basic" because it presents data from the IESO summarizing the hourly generating data for a set of IESO generators - these might be described as market participants, and they might be described as transmission (Tx) or grid-connected. I'll use Tx for this post, and I'll use Dx, for distribution-connected, when discussing what is omitted from basic IESO data and its annual reporting.

I started posting on 2017 feeling the big story was low demand. When the IESO posted their 2017 year-end data summary mid-month, they explained the low demand before informing us what the data "shows":

A mild and wet summer led to lower peak days and reduced total demand for electricity in Ontario last year. The Independent Electricity System Operator’s 2017 electricity data shows that Ontario’s clean and diverse power supply continued to reliably meet the province’s energy needs, while increased participation in conservation programs, growth of demand response and added generation in distribution networks, changing the shape of demand patterns and evolved Ontario’s electricity landscape.[emphasis added]

I don't think it shows all that - and my 2017 included sharing my contempt of the head of the IESO abusing the term "evolution". Those that think evolving is something one entity does to another, in real-time, should be particularly careful to avoid the term.

Evolution is change in the heritable characteristics of biological populations over successive generations. - Wikipedia"Evolution or Revolution" is a saying reflective of a decision to throw everything out and start again, or work with what you've got. From that perspective I can see the IESO approving of evolution - the type where little happens for multiple generations.

Ontario's electricity supply includes a mix of necessary and unnecessary generators. Some example of unnecessary ones were the topic of a post on my Cold Air Currents site one year ago, Ontario's IESO steps off the gas. When I started blogging, in 2010, the minimum hourly output of gas generators appeared to be around 1000 megawatts - in 2017 it was about 300 MW. That "baseload" reduction amounts to an annual reduction of roughly 6 Terawatt-hours (TWh). That has occurred as a previous generation's must-take contracts with non-utility generators (NUGs) conclude. The contracts have ended either through buy-outs, contracts reaching end dates or contracts being renegotiated to pay for capacity (without requiring electricity generation at all times).

Capacity contracts have been seen as evolutionary, but they could end up only being a mutant blip.

The need for capacity resources was exacerbated by the growth of variable Renewable Energy sources (vRES), which include industrial wind turbines (IWTs) and solar panels. The need for running the natural gas-fired generators providing firm capacity was lessened by adding flexibility to IWT and solar panel (I wrote on this in regarding flexibility). Unfortunately this flexibility is achieved by curtailing IWT, and solar panel, output.

The IESO's annual summary reported on "variable generation dispatched down" (to their credit as this metric has taken many months to publish in the past). The 3.33 TWh is shown as 26% of potential generation (from Tx wind generation), up 48% from the 2.24 TWh reported last year. I've noted in the past Ontario rivaled China for IWT curtailment, but with China reportedly reducing it's rate to 12% in 2017, that rivalry seems to have ended. We're number 1.

By the end of the third quarter Ontario Power Generation (OPG) had already reported 4.5 TWh of "forgone hydroelectric production" due to "surplus baseload generation" (SBG). With 23.5 TWh of generation reported during the period, only 84% of the potential hydro supply was utilized. 8.8 TWh of curtailment is already reported for 2017, including 0.96 TWh of "nuclear reductions," so once the fourth quarter curtailment at OPG's hdyro facilities is provided, 10 TWh of wasted supply is a very real possibility.

Combining generated and curtailed totals, 133.8 TWh could have been produced from nuclear and hydro facilities. In a fictional world of perfect storage nuclear and hydro could therefore have met all of the 132.1 TWh of "Ontario Demand" reported by the IESO. This is especially notable as the government rationalized its [un]Fair Hydro Plan as lengthening amortization periods. That's a ludicrous claim as almost all of the hydro and nuclear sites are more than 20-years old and fully paid for, and those that are not paid off were financed, or contracted, well beyond 20-year periods.

The IESO's "Ontario Demand", which they noted was down 3.6% (4.9 TWh) from 2016, is demand for generation from the IESO's Tx generators. It includes supply to compensate for line loss, as well as supply to power generators. It does not include "distributed" (Dx) generation, nor does it include behind-the-meter (BTM) generation. A still imperfect, but better figure, should come from the consumption figures now posted with the global adjustment. The decline in reported consumption was 2.8%, a full TWh less of a decline than "Ontario Demand" which would indicate an increase in distributed generation if the figure was reliable. Unfortunately it is not.

While the IESO's senior management have given multiple conflicting figures for installed capacity of distributed generators in recent months, their monthly summaries in 18-month outlooks contain figures showing little change in total, and reporting on the composition of the global adjustment show solar was down in 2017.

Looking at longer demand trends the growth in capacity of distributed generation does explaine a chunk of the decline in demand for output from the IESO's Tx generators. While there's some data available on that growth, there is next to nothing on behind-the-meter generation (BMG). A recent report notes, "1.1 gigawatts of existing behind the meter generation (BMG)" in commercial operation. If there was a reporting of "Ontario Internal Load", as Alberta's system operator provides for that province, the real consumption trend may look significantly different from the sharp decline of the Tx-only "Ontario Demand" metric.

Costs are, in some ways, easier to analyze than consumption.

Global Adjustment reporting now includes reporting on component costs (.xlsx). Although the component breakdown isn't obvious to many, "solar" is simple enough and that cost fell slightly in 2017. Combined with wind, the costs did rise $150 million over 2016, but the previous year the increase had been $700 million.

Both the weighted average Hourly Ontario Energy Price (HOEP) and total global adjustment charges dropped, and the total supply cost of generation fell. Well tepid growth in renewables was helpful in controlling cost, the decline was entirely due to the sluggish performance of the Ontario Energy Board (OEB) - which I'll return to momentarily.

The component category with the greatest annual increase in 2017 was "Nuclear (non-OPG) and Natural Gas", which was up $736 million to $4.1 billion. I estimate the Bruce Power (nuclear) component of this increase was $316 million (based on TransCanada's annual reporting), costing $2.6 - $2.7 billion. That increase is due to increased output. The remainder (non-nuclear portion) of the increase, which I estimate at $420 million, is not due to increased output as gas-fired generation was down sharply. One reason it was down sharply was the contracts bought out of 5 generators. Those 5 generators had produced approximately 2.5 TWh in 2016. Adding this to the already described 10 TWh of curtailed potential supply, Ontario ratepayers were charged for 12.5 TWh of supply never generated.

19.1 TWh were exported in 2017. Revenues were an estimated $460 million according to the methodology developed for my previous post. The $24.09/MWh average was 21% of the $115.55 average annual Class B commodity charge.

To sum up the oversupply in IESO supplied supply (Tx), 132.1 TWh was needed but 163.7 was paid for, resulting in 19.1 TWh being dumped on export markets and 12.5 TWh abandoned altogether.

For every 7 watt-hours consumed, 2 were wasted or dumped far below cost.

This should not be confused with a responsible supply buffer. The combined cycle gas turbine (CCGT) power plants contracted to be available produced only 8% of their potential output during 2017. This is great for emissions but not for productivity, as similar plants in the United States have average annual capacity factors above 50%. If Ontario's cleanest natural gas-fired generators operated at the U.S. utilization rate, annual output would be 16 TWh higher.

The steep drop in demand for grid-supplied electricity apparent early in 2017 could be one reason the government discounted rates 25% for customers on regulated price plans (with the [un]Fair Hydro Plan), and expanded the Industrial Conservation Initiative for larger consumers to lower costs. Deep discounting was required to limit the drop in demand. With carbon pricing all the rage there have been steady reminders demand curves slope down and to the right. This claim is contradicted by the behaviour of Ontario's electricity sector in 2017. However, while the short-term price elasticity of demand is low, the long-term price elasticity is considerably higher. If the cut in prices is meant to spur consumption, it will require purchases of durable equipment, like heat pumps, water heaters and electric vehicles.

My analyses may seem negative given that actual supply costs didn't go up in 2017, but those rates were maintained only by devaluing the public asset that is Ontario Power Generation (OPG). The share of the global adjustment attributed to OPG dropped $867.1 million from 2016 to 2017, far more than the $482.6 million drop in the entire global adjustment. The drop in OPG's revenues wasn't due to OPG's performance, but the regulator's. In June 2016 I wrote on OPG's rate application to the OEB for 2017, but still nothing meaningful has been decided. The OEB notes this is its biggest case, but note that, for generators, it's also their only case! Perhaps the difficulty of approving rates for regulated nuclear, and hydro-electric, facilties was upped by a desire to smooth rates over time. Here's a smooth idea - look at the rate history of OPG's nuclear generations, and Bruce Power's - the latter negotiated with government directly. There have been smoothed rates, but no where the OEB was involved.

These could be interesting days as Ontario adds electrification of heat and transportation to its electricity sector's low emissions accomplishment, but it may not occur. The promise to later raise rates to pay back [un]Fair Hydro Plan debt is likely to neuter any electrification that may have thrived in the artificially lower rate environment of the [un]Fair Hydro Plan, Industrial Conservation Initiative, and throttling of OPG revenues.

During 2017 the IESO hired Peter Gregg. Gregg had led Enersource, a local distribution company (LDC) which merged with other LDC's after the government opined mergers would be super. Having thus proved his competence, the IESO board scooped him up.

The IESO has increasingly focused on LDC issues - like embedded generation. Gregg blustered right in and reorganized the IESO into 3 units. Two with leaders. Terry Young and Leonard Kula. Since that time many speeches have been delivered by the 3 IESO mandarins. Most lecture on reducing electricity usage and how consumers could become generators too - all while spilling 2/9ths of what is already purchased.

No comments:

Post a Comment