The average cost of power from Darlington nuclear units post-refurbishment is estimated to range between $72/MWh and $81 MWh, or 7 and 8 cents per kilowatt hour.So announced the Ontario government in a January 11th, 2016 news release.

137 days later Ontario Power Generation (OPG) filed an "Payment Amount for Prescribed Generation Facilities" application with the Ontario Energy Board, asking for rates for supply from its nuclear generators to rise to $99/MWh by 2021.

|

| data from OPB_Exl1-1-1_Att1_OPG_RevenueRequirement Work Form_20160527.xlsx filed at OEB |

Anti-nuclear forces will find it very useful.

Wholesale reporter Keith Leslie wrote of "a whopping 69 per cent increase...over the next five years" with quotes from his standard go-to Jack Gibbons, who just days earlier had an editorial in the Toronto Star arguing for the closure of the nuclear reactors at Pickering using some of the same arguments he had discredited 2 years ago (by me in June, and by the IESO/OPA in October), and some other sound-bite emotive appeals developed in the 1970's. [1]

Which doesn't mean Pickering shouldn't be closed.

Having a better record with OPG's financial arguments than they themselves do, I feel obliged to see if OPG's management was just inept in formulating a rate hike that I suspect more likely to scuttle the refurbishment of Darlington's reactors than extend the life of Pickering's, so I'll explore the production and revenue requirement totals with some historical context, and review the poorly chosen "smoothed" option.

This rate hike request reveals some things about what OPG has become, and also reveals shortcomings of the Ontario Energy Board (OEB) in regulating Ontario's electricity sector.

For credibility's sake, and because the data work is still relevant, the May 2013 OPG turning water into debt column I wrote with Parker Gallant may be directly tied to a November 2013 alteration of Ontario Regulation 53/05, requiring OPG's sites previously exposed to market pricing to be assigned regulated rates. In the 19 months since the OEB allowed OPG to recover the regulated rates, OPG has realized about $400 million more than it would have under the market rates.

OPG reported that in the first quarter of 2016 they received 7 cents per kilowatt-hour (¢/kWh) for their nuclear generation. A little digging is required to find that rate composed of a $59.29 per megawatt-hour ($/MWh) payment amount set by the Ontario Energy Board (OEB) and additional riders, clearing up some variance accounts, of $13.01/MWh, approved by the OEB for 2016. The 7 ¢/kWh is more accurately described as $72.30/MWh, 18% of which is due to rate riders.

If the rate paid for OPG nuclear did climb to $99.62/MWh in 2021, that rate would be 38% higher than now paid. This works out almost exactly to the annualized rate of inflation that Ontario's Regulated Price Plan consumers experienced over the past 9 years - for far different reasons.

Reporter Keith Leslie reports "a whopping 69% increase" by taking the "smoothed" 2021 rate of $99.91 and dividing it by today's $59.29 base rate (ignoring the additional rate rider). That's valid in that it compares base rate to base rate, but there's not much reason to assume the high riders of 2016 will be duplicated in 2021. OPG would be wise to assure no such reasons come to exist, and the OEB should already be reviewing its processes to address the current high rate rider which is a failure of, primarily, the OEB - a topic I'll return to.

One way OPG could offer some assurance is to offer a rate freeze through 2018 - which makes more sense than their "smoothed" option. From OPG:

...OPG plans to incorporate a nuclear rate smoothing proposal into the application, with a view of making more stable year-over-year changes in the nuclear base regulated prices during the Darlington refurbishment period. Under rate smoothing, collection of a portion of the approved revenue requirement will be deferred into the future.The rate we pay is now $72.30/MWh - dropping it to $65.81 before raising much higher is not making anything anywhere more stable.

Unless there's going to be a subsequent request for another large rate rider.

Aside from more intelligent rate smoothing, OPG should also present figures in real 2016 dollars - if not for the OEB, for the public. The future of Darlington could well be decided at the ballot box. Perhaps the jerky pricing of OPG's smoothed option recognizes this, and is simply a crass attempts to keep prices lower until after the mid-2018 election.

The following graphic is produced by inflating today's price for nuclear generation from OPG at the average annual RPP rate or increase of the past 9 years, and adjusting all figures to 2016 real dollars using the same 2% annual inflation assumption that ran throughout the 2013 Long-Term energy plan (LTEP):

I think this looks much better, and the "smoothed" payment option here recovers as much as the "unsmoothed" option, which is not the case in OPG's submission - which recovers fewer dollars thus pushing costs out to future ratepayers. However, the 2021 rate, even in 2016 dollars, is $10 to $15/MWh higher than the Darlington refurbishment announcement promised.

I noted earlier I've looked at the performance of different groups within OPG in the past. The nuclear group has had consistent revenues and expenses. In nominal (unadjusted) dollars, here's the history since 2006 along with the projections from the rate application.

Revenues for OPG's nuclear generation business have increased at a rate of less than 2% a year for the past decade. The forecast revenue requirement are not exactly comparable, but clearly the revenue need in OPG's rate application isn't increasing so much as the expected generation is decreasing. A single Darlington reactor averages 6.5 - 7 terawatt-hours a year (billions of kWh), so mostly declined output reflects the refurbishment schedule. The rate requested is moving higher, until 2020, because the denominator (generation) moves lower much more than because the numerator increases.

It's understandable that most of OPG's expenses would not change during refurbishment, but some should. An brief overview of the history of OPG's reactors is needed to demonstrate why.

- 1978 - the Royal Commission on Electric Power Planning reports "CANDU units in the 850 MW range are the obvious economic choice for Ontario Hydro's base load generation". The report expects 30 year lives from Ontario's CANDU reactors which at an 80% capacity factor equates to 210,000 equivalent full-power hours (EFPH). Annex G lists the 1978 reactor licensing status of all reactors currently operational in Ontario [2].

- 1999 - the final annual report of Ontario Hydro presented a different picture, with "decommissioning of nuclear generating stations in the 2042 to 2071 period", following the " removal and replacement of certain fuel channels and steam generators in nuclear generating stations during

the following periods:"

- 2003 - Unit 4 at Pickering returns to service having been the first unit refurbished. The project was over budget and behind schedule. Reviews and recommendations followed

- 2005 - Unit 1 at Pickering returns to service after a better refurbishment experience, but in August OPG decides units 2 and 3 will not be refurbished.[3] By the end of the year the government will contract Bruce Power, through the Bruce Power Refurbishment Implementation Agreement (BPRIA) to refurbish units 1 and 2 of the Bruce A reactors.

- 2008 - the Integrated Power System Plan (IPSP) includes scenarios with the refurbishment of Pickering B units, and without

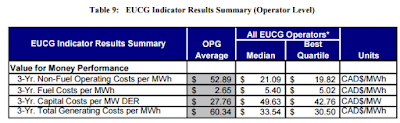

- 2010 - OPG announces in February "Pickering B plant will be operated for up to ten more years and then shut down." On May 26th 2010 an OPG Nuclear 2009 Nuclear Benchmarking Report is filed with the Ontario Energy Board. The report had estimated an average unit cost $92.27/MWh from the 2 remaining Pickering A reactors , $58.58/MWh from the Bruce B reactors and $30.08 from the Darlington reactors. Capital costs at both Pickering stations were just above $32/MW DER (which I'll not differentiate from MWh).[4]

- 2016 - on January 11 the government announced it had, "approved OPG’s plan to pursue continued operation of the Pickering Generating Station beyond 2020 up to 2024"

Pickering has averaged annual production a little over 20 million MWh each of the past 5 years, with 2015 output being the highest from the entire site since 8 reactors operated there. At the reported $32/MW DER, capital costs would have been over $600 million a year. The decisions not to refurbish Pickering units was made in 2010 with the expectation they would not be productive by 2020 - so I'd expect financing costs to drop to $0 by then.

Conversely, OPG's revenue requirement worksheet ups the return of equity by $182.2 million in 2020, ups depreciation/amortization another $140.9 million, ups long-term debt financing by $90.9 million and, just to make everybody but the ratepayer better off, ups regulatory income tax by $69.6 million. There's the roughly half billion dollar increase in 2020, with no evidence of a $600 million benefit.

Shady - but maybe that is just the way the Ontario Energy Board process works. It has been problematic for 3 decades now.

________

OPG is one predecessor to Ontario Hydro, which was broken up in 1998 leaving, by that government's accounting, a large unfunded liability. Ontario Hydro operated on the premise of power at cost to its customers (Ontario), and the regulator was to maintain that based on a principle of ratepayers today should not pay to benefit future ratepayers - thus the cost recovery of large projects, like Darlington, was not to begin until the assets entered service. The problem with that is much of Darlington's cost came from political delays in the project as demand for electricity in the 1980's failed to increase to the extent expected when Ontario planned the project.

Ontario regulators never seemed to figure out it was the ratepayers of the day that benefited from delaying Darlington's completion - which punished ratepayers of the future.

The OEB has similarly failed current ratepayers. The Niagara tunnel project went well over budget, but costs could still not be recovered until the project entered service - since which it has accomplished nothing. The OEB then greatly increased rates on all Ontario's legacy hydro assets to provide OPG a handsome return-on-equity in the unsuccessful project - as they did with the transmission entity, Hydro One, and it's expenses in building the Niagara Reinforcement Transmission line, which likewise provides no value whatsoever to the ratepayers force to pay for it - and ensure Hydro One's profit on it.

Today's rates for OPG's nuclear power is 18% comprised by rate rider which, as best I can tell, are costs the OEB pushed aside until a later date when there would be a better idea of what those costs were. Over half of today's rate ride is due to adjustments for pensions and other post employment benefits.

The OEB has both a long-term and recent history of punishing future ratepayers to the benefit of current ones.

Perhaps this OPG rate application is correcting these past errors and OPG is paying for the refurbishments of the Darlington reactors as they go. If they could hold the rates that's wonderful, but perhaps prudence, and common sense, call for finding some middle ground between funding through today's rates and borrowing to fund through the rates of the following 5-30 years.

Neither the OEB nor OPG seems to have a grasp of this "rate smoothing" thing.

_____

Why does Ontario wish to continue operating Pickering?

Financially, OPG should be able to end Pickering's operation. The Ontario government has added $4.2 billion to its balance sheet, since April 1, 2009, due to increased valuation of nuclear funds established to cover decommissioning and long-term waste handling costs - if there's any responsible in the government that should indicate decommissioning is financed.

Pickering produces electricity without fouling the air with pollutants or contributing to the warming of the planet - but Ontario exports as much electricity as Pickering produces. Ontario usually has far too much supply, but that doesn't mean we always will.

Ontario's need for more supply was disguised in the 2013 Long Term Energy Plan as "flexible capacity." This was priced with the same estimated capacity costs as simple cycle gas turbines (SCGT) - which are cheap to build but use more fuel, and therefore emit more, than the combined cycle gas turbines the province has generously contracted over the past 12 years. However, with gas plant "scandals" due to the political relocation of plants for Toronto's western suburbs to far distant locations, and with the government ramping up climate change rhetoric to position itself as earth's saviour for the election of 2018, the need seems unlikely to be met with natural gas.

Extending the life of the Pickering reactors is an expensive way to meet capacity requirements, but it may be the best option politically.

Operationally, there are no real choices aside from new gas capacity.

The option of importing from Quebec has been explored, and found inadequate. Importing from the U.S. means importing coal-fired generation, should they have any capacity capable of exporting. The IESO, operator of Ontario's electricity system, is just starting to realize they don' t know how to integrate industrial wind turbines into a low carbon system - which isn't surprising as nobody seems to have figured that out. Solar produces nil through many on Ontario's high demand hours, and the latest hydro projects, undertaken by OPG, have been so spectacularly expensive, and produced so little, that OPG is no longer the province's low cost supplier.

Bruce Power is.

Which may give the government an option if OPG can't stick to the price it promised nuclear power for in January - which seems probable given their rate application months later.

End-notes

1. See "A Race Against Time", a 1978 publication from Ontario's Royal Commission on Electric Power Planning - particularly "The Case Against Nuclear Power Section" starting on page 61, which includes:- The critics of nuclear power are confident that an effective programme of energy conservation and efficiency improvement is possible and could significantly reduce the growth rate for electricity without altering existing lifestyles and living standards, thereby making nuclear power unnecessary...

- The safety of nuclear power stations...has not been proven beyond reasonable doubt...

- No method for the safe and permanent disposal of toxic and long-lived high-level radioactive nuclear wastes has been demonstrated...

- The current cost figures for nuclear-generated electricity do not reflect the true costs ...

2. Those listening to those arguing today that Picking should close in 2018 because that's when in license ends might note in 1978's "A Race Against Time" the Pickering A reactors' license was ending June 30, 1982 - then note it's just the end of a licensing period and no reflection of reactor life.

3. the source is https://en.wikipedia.org/wiki/Pickering_Nuclear_Generating_Station

4. DER = Design electrical rating, but throughout the Scott Madden document the capital costs per MW DER are added to "per MWh" calculations, such as in:

5. Here's former head of Ontario nuclear operator Duncan Hawthorne explaining:

"...for Candu reactors [the life or reactor limiter] would be fuel channel integrity, either because of hydrogen uptake or because of elongation...We can go in there and scrape those channels, take samples, we can do hydrogen uptake calculations and on the basis of that we can go from what the original design assumption was, of 175,000 full-power operating hours, and to what we are talking about now, which is 300,000."

DA2EB04DE7

ReplyDeletehacker bulma

kiralık hacker

tütün dünyası

-

-

7BF8398DC7

ReplyDeletehacker kiralama

hacker bulma

tütün dünyası

hacker bulma

hacker kirala