Prior to COVID-19 arriving here in Ontario, and paralyzing society, I'd read some papers dealing with the electricity system. These papers may seem a trivial topic today, but the last major economic shock saw the Green Energy Act successfully lobbied and implemented by people who'd been laying in wait for a crisis to manipulate.

_____

In a conversation on January 24, 2020, at an Ontario Energy Network Event, Terry Young, (IESO Vice President Policy, Engagement and Innovation) interviewed IESO President and CEO Peter Gregg.[1] The VP lobbed a question he figured the head of a storage company would ask if she could use the app for questioning, and the President and CEO responded with what a big area of focus the niche was for the IESO.

40 Days after the IESO’s leadership channeled questions for the head of NRStor Inc., with the President acknowledging even if storage wasn’t economic they’d figure out some tricks to make it so, Blackstone, “one of the world’s leading investment firms”, completed the acquisition of NRStor C&I L.P. The head of NRStor congratulated some financial firms on the sale, indicating it was likely the company was being shopped as the heads of the sole contractor of their products were having a conversation pumping their products.

Storage may be important.

Influence definitely is.

Blackstone would not be the first company deciding the way to get into the Ontario market/bonanza is through purchasing existing “stakeholders” - the industry’s preferred euphemism for insiders.

_____

Three documents I read this year (prior to the COVID-19 pandemic hitting the province) either target the IESO to form policies for the lobby’s technology, or suggest actions that fit into the IESO’s preferences (which are, unfortunately, often dictated by the Electricity Act):

- Replacing Pickering: March 2020 The Next Step in the GTA’s Clean Energy Transition

- Economic Analysis of a Proposed Hydroelectric Pumped Storage Project in Ontario

- Whitepaper on Wind Energy and the Ontario Market

- “Promote conservation and energy efficiency”, and,

- “Develop value-based [Distributed Energy Resource] programs.”

A little more background may have been helpful. For a decade-and-a-half the main supply “purpose” noted in the province’s Electricity Act has been, “to encourage electricity conservation and the efficient use of electricity…”

To the extent policy has focused on conservation and efficiency, it might be seen as delivering some success, outside of pricing, in a Toronto context. Demand has been relatively static despite a 15-20% growth in the number of consumers.

Prospective changes in the energy mix for a post-Pickering Toronto are limited by the local population. People enthused to force industrial wind turbines on distant communities, who had their representatives ban offshore wind to protect their views of the lake: people that refused to allow about 1,400 MW of gas-fueled generators to be built locally, causing what became known as a gas-plant scandal. That generating capacity was built elsewhere, and the Clarington Transformer Station was constructed to allow the transmission system to provide power to replace much of the supply currently provided by Pickering from elsewhere. The paper doesn't mention that, and more. When Darlington’s reactor number 2 went off-line for refurbishment in 2016 the Toronto area lost the first third of the reduction in nuclear supply that will be the result of Pickering closing (assuming all Darlington reactors are refurbished).

There’s no indication of a problem - but the paper provides a solution anyway.

To replace Pickering, the real need is in the full integration of the demand and supply sides. New techniques of integrating demand management with non-emitting DERs [Distributed Energy Resources] , and managing the resources so they provide value to the electricity system…

The market needs to be revised to ensure that the value DERs can provide, including strategic demand reduction, is adequately compensated. This will require development of a sophisticated value of DER tariff…Ahhh - a “tariff” - and "The market."

I’ve seen this grift before. When last I saw this carrot there wasn't the stick of a price on carbon.

Currently what is referred to as the IESO’s market has neither actual buyers nor actual sellers. The so-called “market” was to be revised to include, among other things, locational marginal pricing. That would make electricity more expensive in locations with limited connection to other areas, are major consumers, and have little production - as it should. The idea of having a special “DER tariff”, strikes me as avoiding having a market. Pollution Probe’s document boldly calls for “A transparent cost-benefit system” while conjuring images of market pricing to argue for preferential treatment for the same things that have received preferential treatment as Ontario rates skyrocketed since the Electricity Act was revised to make prioritizing "conservation" and facilitating load management.

Currently what is referred to as the IESO’s market has neither actual buyers nor actual sellers. The so-called “market” was to be revised to include, among other things, locational marginal pricing. That would make electricity more expensive in locations with limited connection to other areas, are major consumers, and have little production - as it should. The idea of having a special “DER tariff”, strikes me as avoiding having a market. Pollution Probe’s document boldly calls for “A transparent cost-benefit system” while conjuring images of market pricing to argue for preferential treatment for the same things that have received preferential treatment as Ontario rates skyrocketed since the Electricity Act was revised to make prioritizing "conservation" and facilitating load management.

“The Next Step in the GTA’s Clean Energy Transition” appeals to the IESO’s conceit that they know market stuff and efficiency to pitch avoiding exposure to market forces for their preferred (soft) path.

_____

Economic Analysis of a Proposed Hydroelectric Pumped Storage Project in Ontario is a document prepared by Navigant Consulting for TC Energy, studying the construction of a project with 8,000 megawatt-hours (MWh) of storage and 1,000 MW generation, or consumption (pumping), capacity.

When the IESO began backing away from an incremental capacity auction, initially planned as the first step in what was promoted as a significant market redesign, the retreat was signaled as its President and CEO told a June industry gathering, “We don’t see nuclear or new (large) hydro assets being acquired through our capacity auction.” I wondered if he was positioning for a particular new nuclear or hydro project - but assumed hydro.

The recent history of hydro contracting is expensive compared to the pricing for not only public hydro, but also nuclear.[2] If hydro wasn’t competitive in a capacity auction, historical evidence doesn’t put the fault on the capacity auction. The statement from the IESO’s CEO caused my inner cynic to wonder what project had lobbyists, or stakeholders, killing the capacity auction: TCEnergy’s pumped storage project is a prime suspect.

There are aspects of the modeling in the Navigant analysis to be skeptical of, but regardless of the likelihood of accuracy the components of its modelling are interesting. The analysis models a value for the project in 6 scenarios. In each scenario the cost of the project is covered by benefits aside from “minimizing the cost of energy.” The largest of these non-energy benefits is “providing flexible capacity”, then “minimizing the cost of operating reserves” and “minimizing costs for ancillary services.” All three of these services are important to the operation of the system - and in Ontario the system operator is currently also the contracting body.

It should be noted, in discussing a pitch on how much contracting a project instead of leaving the market to source alternatives, that Ontario has contacted far more capacity than demand necessitated for over a decade now - at huge expense to ratepayers and, more recently, the provincial treasury.

It must be noted Navigant's analysis is presented as saving the system by reducing expected costs - and not presented to investors as maximizing revenues.

_____

The Whitepaper on Wind Energy and the Ontario Market was prepared for the almost-defunct Canadian Wind Energy Association (CanWEA) by Power Advisory LLC - a consultant long associated with the “renewables’ lobby in Ontario. Like Navigant’s work on TCEnergy’s pump storage proposal, the whitepaper on wind discusses non-energy ($/MWh) revenues/costs in an electricity system.

I estimate the average contracted rate for the output, real or deemed (curtailed), of industrial wind turbines in Ontario is $129 per megawatt-hour (MWh), while the average market value of that output over the past 5 years having been under $14/MWh. It’s a brash industry that goes in with the least valuable electricity in the province and explains how it could be paid more, but I think that’s what Power Advisory does in this whitepaper. In fairness they may be anticipating how future projects, without rich contracts, could provide value. Regardless, the arguments are informative on the different components providing value in an electricity system - they're simply not relevant to low-value generators that are already contracted at high rates.

Power Advisory, arguing for CanWEA, offers 14 recommendations, 13 of which mention Ontario’s system operator (IESO).

The first recommendation is:

The wind energy industry should work with the IESO and other stakeholders within the IESO MRP Energy Workstream to explore improvements to energy production forecasts for variable generation and how the IESO uses these forecasts, along with exploring design and rules to reduce inefficient over-commitment of generators within the ERUC so as to more efficiently utilize available and cost-effective resources such as wind energy in the RTM.So many acronyms - which I could elaborate on but I’ll summarize instead: the IESO should better forecast wind so they can more accurately commit resources in advance. Most electricity systems feature a day-ahead market, and when the IESO was shopping for big-boy pants (an activity they call the Market Renewal Process - or MRP for short/code) they considered a day-ahead market. Outside of Ontario better forecasting has significantly increased the value of wind, but outside of Ontario wind generators try to increase the value of their offering in real ways - including hiring leading tech companies to improve forecasting. In Ontario the IESO stupidly took on central forecasting for intermittent variable generators years ago. The paper’s first recommendation is that the IESO should do better - whereas my first recommendation would be the wind generators should do their own forecasts and be responsible for making up shortfalls in a real-time market like other generators do throughout the world.

Power Advisory’s second recommendation is equally galling:

The wind energy industry should work with the IESO and other stakeholders to determine the supply capability of wind generators to be included within Ontario power system plans and design and regarding rules of IESO [Capacity Auctions] that will result in more accurate methodologies to calculate capacity value from variable generation.The wind industry, and GE in particular, have, in my very-familiar-with-the-statistics opinion, a history of lying about the capacity value of wind in Ontario. The percentage of the nameplate capacity of a resource a system can depend on to avoid load shedding is known, from 15 years of reality, to be very low in Ontario - and the IESO recognizes it as such. In the Annual Planning Outlook produced by the IESO in January wind was shown with a “Summer Effective Capacity” of 11% (Winter 31%). The Capacity Values shown for other provinces in the Pan-Canadian Wind Integration Study, produced by GE Consulting, are generally optimistic, but the values for Ontario are positively asinine (33% is the business-as-usual case dropping to a still-way-too-high 18.4% in a scenario where 35% of Canadian electricity is generated with wind). It’s not the first time GE has done lousy work in predicting metrics for wind in Ontario - which is likely why they were selected to do the study.

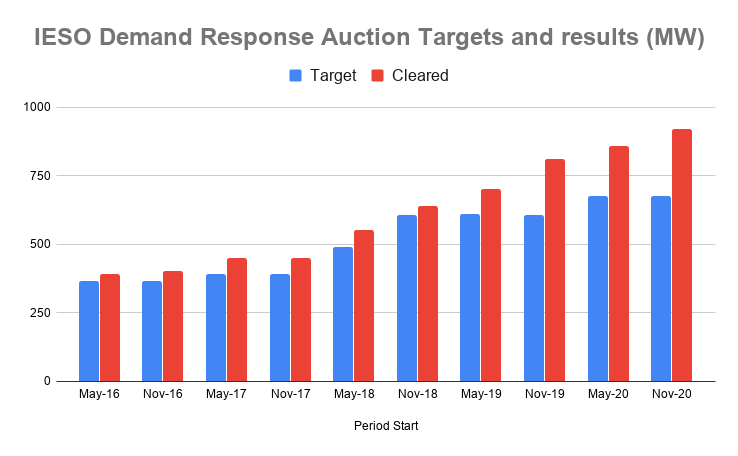

If the desire of the wind industry to “work with the IESO” is perceived as an effort to corrupt metrics of “supply capability”, the interference by stakeholders with the currently planned rules for Capacity Auctions should be perceived as already having done so. Because wind is given a higher capacity value in winter by the IESO, wind lobbied for separate capacity auctions for winter and summer. The oft-altered and always-delayed quest for a capacity auction design was,when last I checked, dominated by demand-response products that have never been called upon. Despite Ontario having excess supply for every winter (periods starting Nov.), the IESO has procured not only more demand response capability every 6 months regardless of season, in recent auctions it has also been procuring far more capability than it has been targeting.

One reason for the misbehaviour of every capacity procurement is attempting to game them to benefit existing ‘stakeholders.’ There is not likely a current need for a winter capacity auction - and wind turbines being more productive in winter doesn’t change that reality. Short of electricity displacing natural gas for heating in the majority of Ontario’s buildings, the province is unlikely to require procuring capacity for the winter beyond the capacity it will require in summers.

This would be a sane proposal in the absence of contracts. Wind can be made to provide ancillary services, such as frequency control, but in order to do so independently output has to be curtailed. South Australia (SA) recently has an event where the state was essentially islanded from the rest of that country’s electricity system. A fascinating (if technical) article on the experience notes:

Power Advisory’s Whitepaper on Wind Energy and the Ontario Market has a number of recommendations that don’t deal with the IESO market - including paying the wind lobby to sell the “environmental attributes” the government holds under existing contracts, paying industrial wind (as in Alberta) for not emitting greenhouse gas emissions instead of just charging those that do, and letting wind facilities sign power purchase agreements with companies who want to pretend they’re powered by wind but are really just connected to the grid (as in Alberta).

One reason for the misbehaviour of every capacity procurement is attempting to game them to benefit existing ‘stakeholders.’ There is not likely a current need for a winter capacity auction - and wind turbines being more productive in winter doesn’t change that reality. Short of electricity displacing natural gas for heating in the majority of Ontario’s buildings, the province is unlikely to require procuring capacity for the winter beyond the capacity it will require in summers.

Recommendation #4 – The wind energy industry should work with the IESO and ... towards permitting wind generators (stand-alone or co-located with other resources such as energy storage) to supply ancillary services and be financially compensated accordingly…Accordingly?

This would be a sane proposal in the absence of contracts. Wind can be made to provide ancillary services, such as frequency control, but in order to do so independently output has to be curtailed. South Australia (SA) recently has an event where the state was essentially islanded from the rest of that country’s electricity system. A fascinating (if technical) article on the experience notes:

Market participants as a group have to cover the total cost of the revenues paid by [Australian Energy Market Operator] to FCAS [Frequency Control Ancillary Services] suppliers…Clever market design would force a cost on generators who don’t provide frequency control, as well as having those that do, “financially compensated accordingly.” It’s highly unlikely such design would benefit industrial wind.

In the first week after separation, generators in SA as a group would have paid out roughly twice in contingency raise FCAS costs what they earned from selling energy. Half these costs went as FCAS revenue to batteries (who would have borne no significant FCAS costs) and the other half almost exclusively to gas generators, who were thus “on both sides of the trade”... You don’t have to be too clever with arithmetic to deduce that wind and solar generators were the big losers.

Power Advisory’s Whitepaper on Wind Energy and the Ontario Market has a number of recommendations that don’t deal with the IESO market - including paying the wind lobby to sell the “environmental attributes” the government holds under existing contracts, paying industrial wind (as in Alberta) for not emitting greenhouse gas emissions instead of just charging those that do, and letting wind facilities sign power purchase agreements with companies who want to pretend they’re powered by wind but are really just connected to the grid (as in Alberta).

_____

Hopefully this post will provide a reference for those wishing to return to locate the whitepapers and studied discussed if the provincial government does appear motivated to do something significant in the electricity sector to spur activity during a recession.

A future post will attempt to tally up the costs from a past government's behaviour in 2008-09, when it placed a huge bet on "green energy."

1. (starting 27:47 into recording)

Endnotes:

VP Young: “So one final question. I’m a little disappointed that Annette Verschuren hasn’t figured out to use Slido so I’ll ask this question for her, and that is your view on storage, and its potential in the future.”2. The IESO reported, for 2019, 36.4 TWh of hydro (36.2 in 2018), This figure includes Ontario Power Generation (OPG) production from regulated facilities, reported as 30.5 TWh in 2019 (29.8 in 2018) - leaving 5.9 TWh of other hydro output on the IESO-controlled grid (ICG) in 2019 (and 6.4 TWh in 2018). Another 1 - 1.2 TWh likely comes from hydro generators embedded in distribution networks. The IESO’s spreadsheet of the component cost of the global adjustment show this remaining hydro adding $723 million to electricity charges in 2019 ($675 million in 2018). Accounting for the market revenues this means the average rate paid to contracted hydro-electric generations has been between $110/MWh and $130/MWh

Pres. and CEO Gregg:

“Sure. I wondered - I usually get a question from Annette. It must have got caught in the ether somehow. Storage is one of those talked about changing technologies, and so we at the IESO believe storage does have a key role in the future, and we’ve done several pilot projects. We’ve invested along with Annette’s company and others. I was actually up at the opening of their compressed air facility up in Goderich which was fascinating! So we do believe there’s a role for storage as a resource in the future. It’s developing. You look back over the last couple of years and you’re seeing costs have significantly come down. You’re seeing new technologies - so it’s changing. So I think the challenge we’ve got is we know there’s value there, and we know it’s part of the puzzle in the future: how do we actually make decisions around it . In a changing environment with lots of innovation happening what we’re trying to avoid is making any long-term bet on any one technology, but really sort-of investing in those technologies to make sure that they’re going to be there in the future - and it’s sort of like striking that balance. So can storage effectively compete right now? Maybe not: maybe we need to look at other elements of the services that storage can actually provide, and provide opportunities for them to compete in those service areas. It’s a big area of focus for us…”

No comments:

Post a Comment