I started writing what became this post as a quick tumblr hit on a single graph - as I started writing I brought in comments on the OCC piece more suited to my coldaircurrents site, and as I felt it necessary to point out the data problems are actually people/organization problems, the work ended up on my more flippant Wordpress site.

The Ontario Chamber of Commerce (OCC) released a report last week:

“ Empowering Ontario: Constraining Costs and Staying Competitive in the Electricity Market, takes a look at the driving factors behind rising electricity costs in Ontario.It’s about time - at best; it may be too late. Near the end of 2015's first quarter I wrote Ontario's new electricity pricing program essentially taxes businesses to fund social program, which concluded many of the OCC’s members would be walloped by coming pricing changes:

Businesses below 3 MW average monthly peak:

- get stiffed with the continuance of the debt retirement charge

- get stiffed with the OESP [Ontario Electricity Support Program]

- get stiffed with the expansion of the class A program

I’m sure that’s confusing to many, but that "Businesses below 3 MW average monthly peak" class of customer did see the commodity rate it pays for electricity rise 25% from 2014′s second quarter to 2015′s, so I’m not surprised there’s some motivation to address the issues. However, the Chamber has more work to do in getting through the confusion.

The OCC report was notably covered in The Globe and mail, The National Post (at least twice), The Toronto Star and by Toronto radio station CFRB. The Star picked up on one aspect of the report that could have been lifted from my work in March:

Reviewing for newbies:

Hard working families should understand the Chamber is right about the debt retirement charge, but other things the OCC gets wrong - things that do hurt decent people. I created the following graphic, and while its story is complex, it will be worth the effort to follow along:

The global adjustment is getting described a lot lately. It is the difference between the costs of procured supply and the money recovered through the sale of that production; it indicates how poorly the market functions and demonstrates the quality of supply and pricing decisions. My estimates of hourly global adjustment totals demonstrates the cost spiral of the second quarter is disproportionately due to growth in the middle of the day - the hours of peak solar energy.

Two things can move the global adjustment - recovery of costs on the market dropping (with price) and the cost of supply rising. With solar feed-in tariffs, both occur: expensive unnecessary supply drives down market price. The graph demonstrates the cost impact exquisitely. The market is increasingly oversupplied with increasingly expensive, increasingly unnecessary generation.

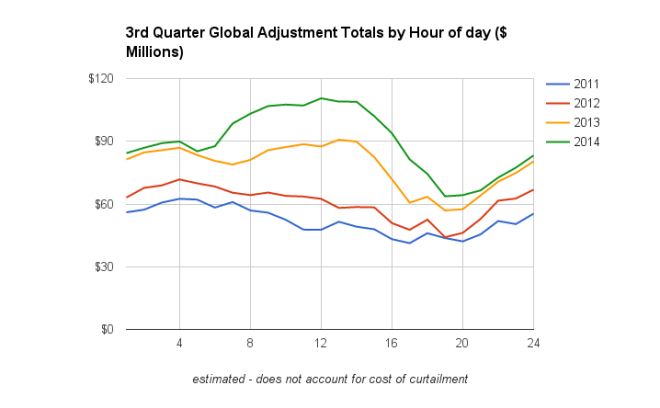

The growth in the global adjustment during solar's peak hours is exceptional in 2015's second quarter, but it's also a constant trend looking at past third quarters. Each year the global adjustment moves disproportionately higher in the middle of the day.

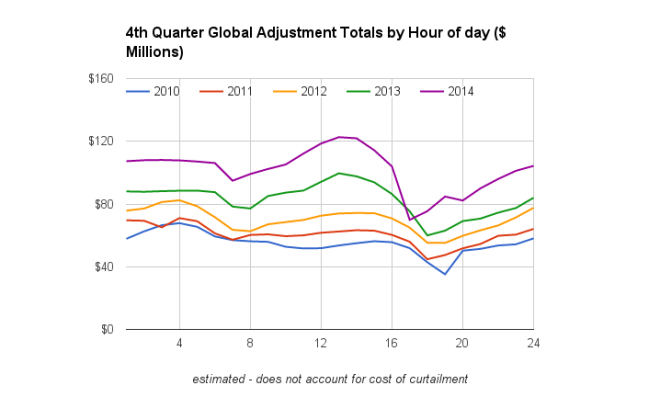

And in the fourth quarter... the same; the global adjustment has pushed higher every year and disproportionately the growth is in the middle of the day.

That big drop at hour 17 (the market always operates in Eastern Standard time) is a warning to watch for price spikes as wind and solar grow. If there's a major blackout this year, I'd bet it occurs at dusk on a cold day later in the year.

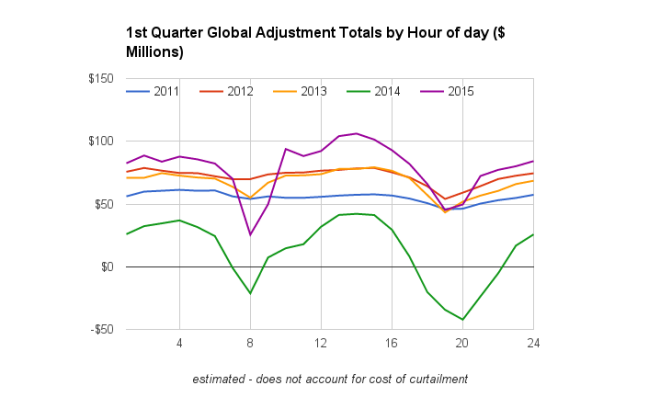

The first quarter is slightly different due to very cold winters in 2014 and 2015, but the trend to the greatest global adjustment costs moving to sunny hours is the same. Note our supply has been better suited to higher demand colder winters, which is indicated by the global adjustment being lowest during the actual peak demand periods.

If Minister Ciarelli is worried about protecting consumers/voters from needless charges, he should halt solar and conservation spending. That would be a far more useful method than breaking laws set by honest people in order to screw businesses. From the Electricity act:

Highlights mainly indicate errors.

The OCC report was notably covered in The Globe and mail, The National Post (at least twice), The Toronto Star and by Toronto radio station CFRB. The Star picked up on one aspect of the report that could have been lifted from my work in March:

[The OCC] wants to ensure residential electricity consumers continue to pay their fair share of hydro costs “Keep the debt retirement charge (DRC) on residential bills until it has been retired, spreading the burden of past government decisions across ratepayers,”I happened to be in the car for a while the day of the release (Wednesday) and one thing I found interesting, but disappointing, is CFRB's early afternoon host didn’t work beyond the businesses want to make “you” pay to give them a break spin, and the drive time team (including prominent Liberal Scott Reid) pushed electricity well back to lengthen pop talk - in this case literally talk about the price of pop at movie theatres. CFRB was, more than The Star, supporting Minister of Energy Ciarelli's spin responding to the report:

The Chamber’s recommendation that hardworking families and seniors pay higher electricity bills is not something our government will accept. We are proud of our commitment to remove the Debt Retirement Charge from residential bills beginning January 1, 2016 –two years earlier than planned. This is an important step in helping Ontario families reduce the cost of electricity by an average of $70 a year.As a former actual smaller business guy (with a small ongoing stake in one), I don't much like the people who vote frivolously and expect somebody else to work harder to compensate. Ending the payment for the voter and choosing to have businesses bear a greater burden is doubly reprehensible - it's just wrong to decide non-voting entities should pay for the mistakes made by governments and it's just stupid to think that won't have a negative impact on the economy.

Reviewing for newbies:

- the stranded debt is a farce

- the stranded debt is a bigger farce if the proceeds of selling of any portion of Hydro One don't pay down debt

- despite the extended farce the "residual stranded debt" is unlikely to show in the fall financial report above $2.5 billion

- the government has paid out about $1 billion each year since 2011 for the Ontario Clean Energy Benefit (OCEB), for a total of about $5 billion by the time the freebie expires

Hard working families should understand the Chamber is right about the debt retirement charge, but other things the OCC gets wrong - things that do hurt decent people. I created the following graphic, and while its story is complex, it will be worth the effort to follow along:

|

| 2nd quarter global adjustment distribution by hour of the day |

Two things can move the global adjustment - recovery of costs on the market dropping (with price) and the cost of supply rising. With solar feed-in tariffs, both occur: expensive unnecessary supply drives down market price. The graph demonstrates the cost impact exquisitely. The market is increasingly oversupplied with increasingly expensive, increasingly unnecessary generation.

The growth in the global adjustment during solar's peak hours is exceptional in 2015's second quarter, but it's also a constant trend looking at past third quarters. Each year the global adjustment moves disproportionately higher in the middle of the day.

|

| Third quarter estimated global adjustment composition by hour of the day |

|

| fourth quarter estimated global adjustment composition by hour of the day |

The first quarter is slightly different due to very cold winters in 2014 and 2015, but the trend to the greatest global adjustment costs moving to sunny hours is the same. Note our supply has been better suited to higher demand colder winters, which is indicated by the global adjustment being lowest during the actual peak demand periods.

|

| Estimated first quarter distribution of global adjustment charges by hour of the day |

Duty to pay debt retirement charge

(4) Every user shall pay to the Financial Corporation a debt retirement charge in respect of the amount of electricity consumed in Ontario, to be calculated at the prescribed rate or rates...

I'll try to quickly cover a couple of other points of what is largely a useful, and readable, report from the Ontario Chamber of Commerce. Two of their "High Potential" actions that could mitigate electricity pricing increases are:

1. Increase transparency of electricity pricing and system cost drivers

5. Unlock the power of smart meter data by capitalizing on data analytics at a province-wide levelThat's sweet, but step one should actually be to develop an organization capable of understanding electricity pricing and system cost drivers. I have some familiarity working with data, and it's as much about discipline as it is about numeracy or systems competency. Here's the meat of the home page of the IESO - the organization people suppose might provide more meaningful reporting if only it were more transparent:

|

| IESO home page - data summary section |

- the IESO market is always on Eastern Standard Time (EST) - so the "EDT" time is wrong throughout

- hourly Ontario energy demand is an average of 12 intervals - there is always a most recent hour's demand, but seldom a current hour's demand

- current hourly price is the same lax terminology. HOEP comes from 12 market control price intervals; there is always a most recent HEOP, seldom a current one

- noting the huge cost impact of solar, as I have, I note they have a number for embedded generation that is over 6 months old.

Not much discipline there, and reality is the IESO reports neither what people outside of their small circle would recognize as demand, nor what casual observers should think of as supply.

What is a smart meter to do when only curious (and talented) outsiders can note the enormous increases in "On-Peak" global adjustment dollars?

I can't imagine a smart meter system could be programmed to advise severely increasing the on-peak time-of-use rate during the second quarter of 2015 - as the Ontario Energy Board did for Summer 2015.

The OCC report errs in calling for both "unlocking the power of smart meter data" and "[increasing] the peak-to-off-peak ratio under time-of-use pricing." That error is indicative of the deeply confused culture the pop sensation policies of the past 7 years developed.

My data analysis indicates the highest potential action for mitigating electricity price increases is now sourcing technically qualified new people, from different cultures, to lead in policy and execution.

Note: the spreadsheet with graphics for this post is here

C10787D23E

ReplyDeletesms onay

Telegram Coin Botları

Kredi Çıkaran Firmalar

Bayan Takipçi

Organik Takipçi