This post

continues the analysis, of Ontario electricity sector data, that is

loosely guided by Chapter 6 of a recent study from the Oxford

Institute for Energy Studies. Previously I demonstrated what typical wind

production will look like in the coming years.

Now we’ll look at the overall supply picture in an Ontario context.

Ontario’s electricity system is characterized

by a very large nuclear component, and a significant hydro component that

generally lacks reservoirs. As demand

has dropped in recent years (it peaked in 2005), intermittent sources

have come into the generation mix on a ‘must take’ basis. I’ll address the current mix this has left us, and the issues already apparent in Ontario due to that mix,

before forecasting some figures for future years.

My starting

point for modelling consumption is hourly generation data for 365 days

beginning September 15th, 2010.

During this timeframe it’s important to note that Ontario consumed about

142.1 TWh, but generated about 153TWh.

The Hourly Ontario Energy Price (HOEP) average is $32.76 over that

time, so our current export levels are driven by a supply mix issue - not profits. My

evaluations do not incorporate exports. 142 TWh is approximately what Ontario's consumption was in 1989 - my evaluations do not incorporate increase/decreases in demand.

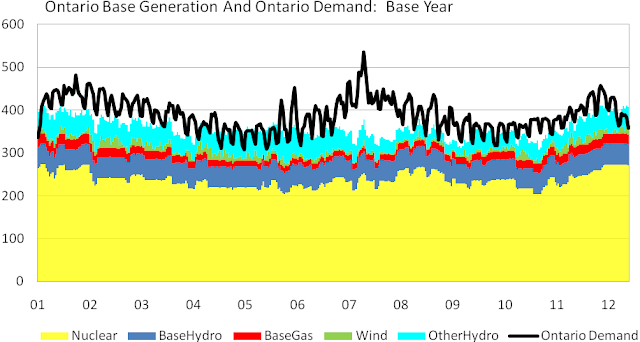

This graph

is formatted to mimic the graph on page 67 of the Oxford study, which is grabbed from the screen

and presented here as “Figure 39.” I’ve

copied the colours, units and stacking order. It's a rather stunning difference!

In Ontario we have one of the lowest emissions intensity generation

systems on the planet, characterized by a large, inflexible nuclear component

and a large hydroelectric component (shown at 110 g CO2 eq / kWh in the 2009 Canadian GHG Inventory reporting). In

the UK they run baseload coal and have a large natural gas component. The Oxford study, forecasting out past 2020, concluded “the demand for

gas is remarkably robust” despite enormous growth in Industrial Wind Turbines

(IWT’s), due to both “the inherent need for gas to provide flexible balancing

for wind and the significant variability of wind generation,” and a void left

by retiring coal-fired generation. In

Ontario, the question is will increased industrial wind turbine (IWT) capacity necessitate replacing existing low-emission baseload sources (nuclear), with

flexible high-emission sources (natural gas).

The term

Surplus Baseload Generation (SBG) has become prominent in Ontario’s electricity

sector since 2009’s recession drove down demand (which was already declining at

a slow rate). Baseload primarily

referred to nuclear (the CANDU reactors in Ontario are not currently capable of

following load - although some can avoid producing at full output, there is no

cost savings in doing so), and a significant portion of our hydro generation

which is basically run-of-the-river. The

rest of the hydro is also available on a use-it-or-lose-it basis, but the

output can be varied by hours, or maybe days.

Baseload also refers to other supply, including a group known as

non-utility generators (or NUGs), as well as supply that must be taken when

available (this is how the wind contracts in Ontario have been

structured). Here’s another chart from

the same data set behind the previous Ontario chart – this time baseload

sources are broken out (using IESO figures as the basis for estimating baseload

amounts) – a black line indicates Ontario's demand level:

These are daily totals, masking much of Ontario’s problem of

surplus baseload generation (SBG), which is far more pronounced between

midnight and 6 am. Regardless, anytime

the supply bars exceed the height of the black line representing demand,

Ontario is a net exporter. April 7th

is the only day on this chart where Ontario was a net importer of

electricity.

I want to

concentrate on the graph below the red, natural gas generation, bars. This represents supply that is either

baseload, or the category I’ve title “OtherHydro” which is included because it

is assumed it will be utilized, having no incremental emissions, or any cost of

production. What is particularly

interesting, and indicative of a very damaged market structure, is the largest white

space, between the base generation bars and the demand line, matches the lowest

commodity rate of the year concurrent with July's heat; and the excess of baseload seen from the middle of

April right through the lower demand spring season, matches the highest price of the year. I think it is evident it does not pay to

commit to too much supply.

This is the

view I wish to replicate in communicating the forecast for future years. It seems to me we want to fill the white space with a cleaner supply, without going over the black demand line. Forecasting doesn't bear that out.

The forecasting is based on the same supply

mix chart that provided the graphing

in my previous post. The nuclear

production pattern is calculated monthly, by taking the monthly production

totals from the years 2006-2008, and calculating the monthly capacity factor

for all nuclear by using the nuclear capacity of 11446MW, which was constant

through those 3 years. The years were

chosen as they contained neither vacuum building outages (exclusive to CANDU

reactors), nor prolonged periods of surplus baseload generation (SBG). There are a number of assumptions made

regarding future nuclear capacity here.

They include:

- Pickering continues operation until refurbishments are concluded

- Pickering, and Bruce A units 3 and 4 have work done to extend their operations prior to the major refurbishments beginning in 2015 (the equivalent of one Bruce reactor is planned offline following the return of two other Bruce reactors in 2012).

- 3 reactors, of the 10 to be refurbished at the Bruce and Darlington sites, are under refurbishment at any one time, beginning in 2015 and running until 2022

- When refurbishment concludes in 2022, Pickering is retired from service

This is one

scenario that is plausible. With some

question as to Pickering, it’s the scenario from the government’s long-term

energy plan tinkered with due to other information including the Ontario Power

Authority’s documents related to the Integrated Power System Plan development.

Baseload

hydro is taken from IESO 18-month outlook, by working with figures from the 10th

week of 2012 and going through the 9th week of 2013. The figure is adjusted proportionately with

the increase in hydro supply in the years up to 2022. The ‘OtherHydro’ category is also adjusted

proportionally. The wind process is the

same, and unchanged from yesterday’s post.

Notably absent is solar output.

The reason is I simply have no data to forecast ouput

with (if you have estimated capacity factors by month and hour of the day

please email

them, and I’ll find some time to add the figures) – the reason I find

that acceptable is generally the SBG hours are at night, and solar will be more

related to issues of peaking, and the utilization rates of natural gas

facilities. Both are important to

pricing, but beyond the scope of this post.

By 2014 my

forecast has about 300MW more hydro capacity, 765MW more nuclear capacity, and

about 2000MW more wind capacity (most of these are based on OPA

reporting). This mix pushes these

sources up to supplying most of Ontario’s demand with the exception of some

cold winter days, and, primarily, the heat of July.

In 2014 the expectation is that exporting, or dumping, is necessary much of the time, and is likely to be accompanied by paying generators to curtail supply (I wrote on some methods the IESO currently has to curtail supply here). But the amount of demand space needing to be filled, most likely by natural gas generators, has shrunk.

By

2018 nuclear capacity is reduced 1750MW

(from 2014 levels) , due to refurbishment activities, while hydro increases by

about 700MW and wind by another 3000MW. Despite adding about 2000MW of supply, more white space on the graph indicates more peaking supply is needed. Similarly, the erratic nature of

wind supply results in far more ‘baseload’ supply than demand is expected to be

able to handle.

Things don't change much between 2018 and 2022. When the final 3 refurbishments return to service, Pickering is retired and that likely will be a trade-off (Bruce and Darlington units have had much higher lifetime capacity factors) - so the 2018 graph likely won't change very significantly. And that would then remain substantially true through at least 2035.

I stated I'd examine the supply mix issues and estimate a price for the decisions being made in the offices of the Minister of Energy. The costing will wait on another post. Aside from the omission of all figures regarding solar, there are questions of capacity to meet system peak, and the costs of diminishing utilization of resources. This post shows the costs of producing too much supply is a very real concern, and illustrates the reasons the IESO seeks to ensure supply response/curtailment processes are in place for intermittent generation supply (re: a process to pay wind suppliers for the output foregone because the grid can’t accept it.)

Looking at the chart for today, it doesn't seem that daunting a task to fill the gaps with cleaner supply.

Looking at the chart for 2018, it doesn't seem that was the task we addressed. The task we addressed was adding more renewables - but we can't demonstrate why.

"...we should ask ourselves what our aim is. Is it to stop climate breakdown, or is it to engineer the maximum roll-out of renewable power? Sometimes it seems to me that greens are putting renewables first, climate change second."

NEXT: Industrial Wind, SBG, $3.3 billion ... and more

Wow that was strange. I just wrote an very long comment but after I clicked submit my comment didn't appear. Grrrr... well I'm not writing all that over again.

ReplyDeleteAnyways, just wanted to say great blog!

Look into my web site: how many calories do you burn walking

My web page - walking calculator

Valuable information. Lucky me I discovered your web site accidentally, and I'm surprised why this twist of fate did not happened in advance! I bookmarked it.

ReplyDeleteFeel free to visit my blog post :: Rmr Calculator

I need to to thank you for this wonderful read!

ReplyDelete! I certainly loved every bit of it. I've got you book marked to look at new stuff you post…

Here is my website ... what is a graduate certificate

42B1B7F613

ReplyDeleteBeğeni Satın Al

Mobil Ödeme Takipçi

Bot Takipçi Atma