The foundation for the post has to be a little dry.

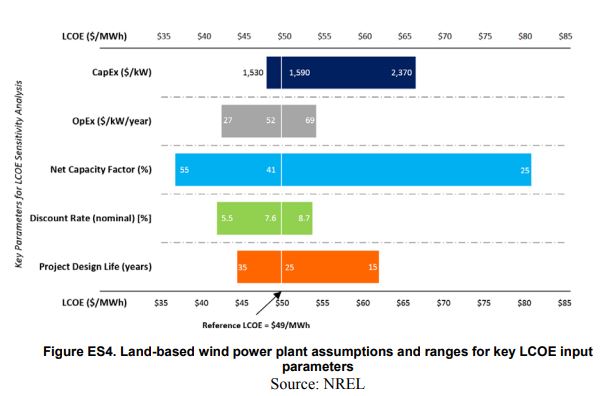

The world of cost estimates for electricity is complex, but it's not hard to understand the capital expenditure (CapEx) per Watt of generating capacity is important element. This excellent graphic, from the respected National Renewable Energy Laboratory (NREL) 2016 Cost of Wind Energy Review, puts CapEx at the top of its cost parameters stack

At today's currency values the U.S. report's $1530-$2370/kW range equates to a $2000-$3100 in Canadian dollars.

The NREL report builds on figures from the U.S. Department of Energy 2016 Wind Technologies Market Report. Drilling into some numbers shared for that report reveals most projects were built with CapEx below $1800USD/kW ($2360CDN/kW), and that in real dollars that $2360CDN/kW is an above average cost over the past 20 years.

It is also notable that the highest pricing of the past 2 decades, per Watt of capacity, occurred about the time (2009-10) Premier Dalton McGuinty introduced Ontario's lucrative feed-in tariff contract mechanism - or perhaps it would be more correct to say Ontario's Premier introduced Germany's feed-in tariff contracts to Ontario.

The International Renewable Energy Ageny (IRENA) Renewable Power Generation Costs in 2017 report agrees with NREL's figures, and notes similar 2016 weighted average pricing for onshore wind in North America, Europe, South America (excluding Brazil), and Eurasia. Call it $2,400 Canadian per kilowatt of onshore industrial wind turbine (IWT) capacity.

This background on capital expenditures (CapEx) in constructing industrial wind turbine projects provides a basis for analyzing 3 Ontario projects that have recently been in the province's news.

Amherst Island

A July 28th article in Kingston's Whig-Standard [1] began:

Several sub-contractors who built the Amherst Island wind turbine project have filed liens in a Napanee court looking to be paid millions of dollars owed for unpaid work.A backgrounder on this feed-in tariff contract will be necessary to understand some of the issues noted at the projects I will be covering.

A feed-in tariff (FIT) contract for a 75megawatt (MW) capacity Amherst Island Wind Project was announced on February 24, 2011. A recent list of Active Contracts produced by the system operation (IESO) shows the contract date less than I month later (March 25) with a very generous Milestone Commercial Operation Date (MCOD) of January 27, 2016. FITs were offered generous financial terms for reasons that included a desire to see them in service within 3 years with much of the procurement made locally. By December 2012 the local requirements were turfed by a World Trade Organization ruling, and contracts were having MCOD's moved to 4 years out from the contract date (reportedly in return for concessions from the contract holders).

It's unclear to me how the MCOD for the Amherst Island was moved to over 58 months after the contract date, and it appears that it's not the only time requirement to have changed. The IESO shows a commercial operation date (COD) of June 15th, 2018, despite "an Event of Default" specified the original FIT contract:

Twice the average CapEx expenditure.

The delay did soothe that profligate spending for the proponent due to the more modern industrial wind turbines, as they are likely to have capacity factors significantly higher than models available in 2011.[2] In July, the first full month of operation for the Amherst Island IWT facility, it achieved a capacity factor 7.7% higher than the nearby units at the much older Wolfe Island facility (2009) . While I will note one really shouldn't extrapolate the variance in performance during low-output July to guess full-year performance, a 7-8% improvement in capacity factor over the past decade, due to improved turbine design and operation, would not be surprising.

Higher output may justify the higher CapEx spending from the perspective of the owners of the contracts/projects, but they do so by increasing the expense of the contract to Ontario ratepayers (present, or future), or taxpayers (present, or future).

Last word on Amherst: the liens on properties, fights for payments from out-of-province contractors, and high spending come 9 years after the Green Energy Act was introduced with the promise to develop a local industry with the strength to export its excellence.

I would not be surprised if the developers of Ontario's feed-in tariff program honestly expected it to bring quality work from a blossoming reputable industry in Ontario, but it has not.

I wouldn't be surprised if signing contracts that clearly identified Ontario as the biggest mark in the western world brought an industry that sees the public as servicing them, and not the other way around.

Ontario's new government should not perceive the problem as being solely with the equipment of installers. George Smitherman, "the former Ontario cabinet minister who introduced the [Green Energy Act]," which led to the burst of feed-in tariff contracting, explained in a 2015 interview that "We were trying to nurture the white-collar side of green energy as well. There is [now] a big cluster of renewable related jobs in the downtown core of Toronto." Those jobs are the bigger problem - most of the people in the neighbourhood the government would seek expert advice are expert only at driving consumer costs skyward.

There may be a wind industry offering value to consumers, but it is not the industry that developed in Toronto around forcing industrial wind turbines elsewhere in Ontario.

1. The original link to the article is not functioning as I write this. I located it using the "wayback machine".

2. The capacity factor is calculated as the output of the facility over a period of time divided by what the output would have been if it had always output its full nameplate capacity.

3. The feed-in tariff rate was $135/MWh at the time the original contract was signed, and the project is reportedly half owned by Henvey Inlet First Nation (through Nigig Power Corp.), which would maximize the aboriginal adder at another $15/MWh.

It's unclear to me how the MCOD for the Amherst Island was moved to over 58 months after the contract date, and it appears that it's not the only time requirement to have changed. The IESO shows a commercial operation date (COD) of June 15th, 2018, despite "an Event of Default" specified the original FIT contract:

"The Commercial Operation Date has not occurred on or before the date which is 18The article in the Whig-Standard quotes a sub-contractor (the main contractor was reportedly based in Newfoundland):

months after the Milestone Date for Commercial Operation..."

"They were going to be heavily penalized if they were not on line with power at the drop dead date at the end of June so they met that and all the trades worked hard to get that..."The project proponent benefited from the many delays and extensions the IESO apparently revised the contract to allow - unlike those living in the vicinity of the project. A sunken barge causing a boil water advisory came near the beginning of the final construction push, and the recent article quotes Rob Scoffield of "wind turbine construction company" QCE Canada indicating it got better:

"What they did to the local people and landowners is despicable, I've never seen it, I've been 18 years all over the world doing wind parks and I've never seen them behave to local people like they did on this project."The August 24, 2015 Renewable Energy Approval for the project describes the "facility" as including 26 "Siemens SWT 3.2-113 wind turbine generators" - a model that was not possible to order for more than 3 years after the project's contract date. I've shown the CapEx per unit of capacity dropping significantly during the years the project was granted delays, yet the article alleges some huge expense on the project.

During the construction, Scoffield said, Algonquin Power and Pennecon had fallen behind on the project and have had cost overruns of about $90 million.

It's a $400- to $450-million project now, he said.That's $5,333-$6,000 per kW.

Twice the average CapEx expenditure.

The delay did soothe that profligate spending for the proponent due to the more modern industrial wind turbines, as they are likely to have capacity factors significantly higher than models available in 2011.[2] In July, the first full month of operation for the Amherst Island IWT facility, it achieved a capacity factor 7.7% higher than the nearby units at the much older Wolfe Island facility (2009) . While I will note one really shouldn't extrapolate the variance in performance during low-output July to guess full-year performance, a 7-8% improvement in capacity factor over the past decade, due to improved turbine design and operation, would not be surprising.

Higher output may justify the higher CapEx spending from the perspective of the owners of the contracts/projects, but they do so by increasing the expense of the contract to Ontario ratepayers (present, or future), or taxpayers (present, or future).

Last word on Amherst: the liens on properties, fights for payments from out-of-province contractors, and high spending come 9 years after the Green Energy Act was introduced with the promise to develop a local industry with the strength to export its excellence.

White Pines

"Cancelling Ontario’s White Pines could cost $100 million says company.”So begins The (Wellington) Times commentary, written by Rick Conroy. I won't dwell too much on the events leading to Ontario's new government passing a law specifically to cancel the project and force what's been done to be decommissioned as Mr. Conroy writes better than I and runs a truly independent small-town paper that deserves more readers. Fortunately he picks up some of my work so I'll try to restrain myself to estimating CapEx and addressing some of the numbers floated regarding the cost of the cancellation.

The White Pines FIT contract was announced April 8, 2010.

The contract date is listed by the IESO as June 15th 2010; as with Amherst Island's project the MCOD is now listed as more than 4 1/2years later, on January 6, 2015. That means by the time the project was cancelled it was more than 42 months past the MCOD. The lengthened periods between contract and MCOD, and MCOD and Commercial Operation, are not the only 2 alterations to the standard feed-in tariff contract of 2010. The project that was awarded a FIT contract in 2010 was 60 MW. Most of the turbine locations were rejected by an environmental tribunal - which many, including me, assumed would be a death sentence as we understood the FIT contract required a minimum of 75% of the contracted capacity be built.

Regardless, some turbines were installed when legislation to cancel the shrunken-to-18.45 MW project appeared.

The President of the company building the project, WPD Canada, reportedly said if legislation was introduced to force the cancellation was introduced (it was) they'd take legal action "in the nine figures at least." This seems to have been the source of the $100 million "Dr. Evil" figure. Because WPD is a German developer this news was covered by Handelsblatt, which reported the firm's investment at €53 million - a little over $80 million Canadian dollars. $80 million - $100 million is a CapEx range of $4336 - $5420. Obviously very high compared to elsewhere in the world, but at first glance not so bad as Amherst Island's project if the numbers noted earlier are correct - but the WPD project used an older model of turbine so productivity per unit of capacity would likely have been lower.

The White Pines Wind Project Termination Act, 2018, received assent on July 25th. It does provide for compensation for the developer to recover reasonable costs. Some claim this means Ontario is spending the Dr. Evil-ish $100 million for nothing. There is a fallacy of sunk costs aspect to this claim. Assuming a 32% capacity factor, at the FIT rate of $135/MWh the cost to ratepayers would have been around $7 million a year, for 20 years. Some of that cost would be recouped by sales into Ontario's so-called electricity market. The nearby Wolfe Island Wind facility has been operating since mid-2009, and we know its average value at the Hourly Ontario Energy Price (HOEP) has been $23/MWh over those 9 years. There are a lot of assumptions which could be made to result in a lot of forecasts for the next 20 years, but if we assume only the value of wind will remain what it's been, roughly $1.2 million in revenue will be lost each year in avoiding the $7 million cost of the now cancelled White Pines project. The net loss each year would have been, in this scenario, $5.8 million per year, totalling $116 million (nominal) over 20 years.

I don't think the perspective that we are suddenly paying $100 million for nothing is correct. The money was wasted back in 2010 when the contract was signed - it's just being recognized as a loss now.

Lastly, it may not be easy to determine what costs incurred by WPD are reasonable. Nine Senvion MM92 wind turbines were reportedly ordered by WPD for White Pines in October 2017, almost 5 years after 51 MM92 turbines were announced ordered by wpd for six Ontario projects, including the much larger 60 MW planned for White Pines and 9 turbines for the 18.4 MW Fairview Wind Farm which was dropped due to Environmental Review Tribunal (ERT) findings.

I am only aware of 3 substantial reductions in contracted capacity due to ERT findings. Two of those were against WPD, and eliminated 60 of the 105 MW for which they'd ordered turbines in 2012.

Henvy Inlet

The Henvy Inlet industrial wind project has not gotten nearly as much attention as the White Pines and Amherst Island turbines. While local resistance might be attributed to delays in constructing other sites, I am unaware of significant local opposition to what is the largest, and most expensive, of all Ontario's contracts for land-based industrial wind facilities.

The Henvey Inlet FIT contract was announced on February 24, 2011 (along with Amherst Island and many others). The contract date is now shown as June 22nd, 2011. The Milestone Commercial Operation Date (MCOD) was greatly extended; more than doubled from the 3-year expectation of original feed-in tariff contracts to February 25, 2018. If the FIT contract's 18-month requirement remained, from MCOD to actual Commercial Operation Date, the project would need to be significantly complete by August 2019.

The wind industry has been likened to the wildcatters during the oil boom – risk takers seeking out ever more land on which to extract energy to fuel our nation’s power demands. While some energy companies have made efforts to be good corporate citizens, profits in the energy industry have attracted some players of dubious integrity.

- Who is Pattern Energy, April 2012, East County Magazine

In November 2014 the contract holder, a company owned by the Henvey Inlet First Nation, signed a joint venture with Pattern Energy. Pattern has been very active in Ontario as the massive deal signed with a Korean Consortium, intended to kick-off a clean energy revolution in Ontario around bringing Samsung's manufacturing expertise to Ontario, was mostly sourced out to Pattern for completion. Pattern's Ontario interests include the two largest operating industrial wind facilities, K2 and South Kent.

Unlike WPD's White Pine experience, the industrial wind turbines for Henvey Inlet were only ordered at the end of 2017. The Vestas V136-3.45MW turbines will have 132 metre tall towers. The combination is designed, "to deliver high and efficient energy production in low-wind

conditions, the Henvey Inlet project will harvest more wind, delivering lower cost of energy." This is not a level of performance that existed early in 2011 or was anticipated to exist by 2014 -when commercial operation was to commence.

Pattern announced the completion of a "C$1 billion financing for the 300 megawatt (MW) Henvey Inlet Wind project" on December 26th, 2017.

$3,333/kW.

While better than the average cost at White Pines, and Amherst Island, this cost is the most damning of whatever term is used for the industry driving wind costs in Ontario. 16 days before Pattern Energy announced the purchase of Vestas V136 turbines for the Henvey Inlet wind project, likely costing ratepayers $150/MWh[3], the government of Alberta announced the results of an auction for renewable energy. Alberta's system operator reported, "nearly 600 MW of wind generation at a weighted average bid price of $37/MWh." CBC reported the successful companies, "are to spend about $1 billion to build four wind power projects," and noted the, "projects are to open in 2019."

Ontario's Henvey Inlet project has a CapEx cost of twice those projects in Alberta - all of which plan on using the Vestas V136. Ontarians would be lucky to pay twice the price though - they'll pay 4 times more from power from the same model of turbines entering service in the same year.

Pattern announced the completion of a "C$1 billion financing for the 300 megawatt (MW) Henvey Inlet Wind project" on December 26th, 2017.

$3,333/kW.

While better than the average cost at White Pines, and Amherst Island, this cost is the most damning of whatever term is used for the industry driving wind costs in Ontario. 16 days before Pattern Energy announced the purchase of Vestas V136 turbines for the Henvey Inlet wind project, likely costing ratepayers $150/MWh[3], the government of Alberta announced the results of an auction for renewable energy. Alberta's system operator reported, "nearly 600 MW of wind generation at a weighted average bid price of $37/MWh." CBC reported the successful companies, "are to spend about $1 billion to build four wind power projects," and noted the, "projects are to open in 2019."

Ontario's Henvey Inlet project has a CapEx cost of twice those projects in Alberta - all of which plan on using the Vestas V136. Ontarians would be lucky to pay twice the price though - they'll pay 4 times more from power from the same model of turbines entering service in the same year.

Despite the rich contract and heavy spending the construction of the Henvy Inlet industrial wind facility is not going smoothly. It is implicated in starting a fire known as Parry Sound 33. The CBC reported:

"During the week, as we proceeded through work, there were fires that started up from our machines … little fires," [one worker] said. "But this one started and it was too big for [workers] to control. And it got out of hand and it turned into devastation."

...

The workers said their bosses were pushing for seven-day work weeks and were also considering night shifts to keep up with the project developer's schedule.

"They were still blasting every day, sometimes two or three shots a day," one worker said, despite the extreme fire-hazard conditions. "We've had fires start off beside blasting mats, but it still went on every day."

Conclusion

I would not be surprised if the developers of Ontario's feed-in tariff program honestly expected it to bring quality work from a blossoming reputable industry in Ontario, but it has not.

I wouldn't be surprised if signing contracts that clearly identified Ontario as the biggest mark in the western world brought an industry that sees the public as servicing them, and not the other way around.

Ontario's new government should not perceive the problem as being solely with the equipment of installers. George Smitherman, "the former Ontario cabinet minister who introduced the [Green Energy Act]," which led to the burst of feed-in tariff contracting, explained in a 2015 interview that "We were trying to nurture the white-collar side of green energy as well. There is [now] a big cluster of renewable related jobs in the downtown core of Toronto." Those jobs are the bigger problem - most of the people in the neighbourhood the government would seek expert advice are expert only at driving consumer costs skyward.

There may be a wind industry offering value to consumers, but it is not the industry that developed in Toronto around forcing industrial wind turbines elsewhere in Ontario.

Postscript

An article by Edgar Sepulveda noted the government had given up its right to cancel contracts fro missing timelines in the lead-up to the fall 2011 election. From an August 2nd, 2011 post on the McCarthy Tetrault site:

The Ontario Power Authority (OPA) announced a change to its Feed-in-Tariff (FIT) program yesterday that will alleviate a significant amount of uncertainty for project developers.It seems I wrote a post on the predicable outcome of cancelling the ability to cancel badly managed projects.

Although the "termination at will" right of the OPA was originally intended to be used by the OPA to terminate badly managed projects, with the election uncertainty industry became much more concerned that Section 2.4 could be used as a political tool by an incoming government to cancel FIT Projects on a discretionary basis (through the OPA as its proxy) at a relatively small cost.

However, the OPA’s recent announcement alters the OPA’s "termination at will" right and, consequently, the ability of an incoming government to cancel FIT projects through the provisions of the FIT Contract alone...

so... the 3 rotten wind projects I wrote on last week (including the one implicated in starting the Parry Sound 33 fire) are old poor projects that would likely have been cancelled if not for the 2011 election strategy of one Dalton McGuinty.https://t.co/qYFXYwFPeC— Cold Air (@ScottLuft) August 10, 2018

End-notes

1. The original link to the article is not functioning as I write this. I located it using the "wayback machine".

2. The capacity factor is calculated as the output of the facility over a period of time divided by what the output would have been if it had always output its full nameplate capacity.

3. The feed-in tariff rate was $135/MWh at the time the original contract was signed, and the project is reportedly half owned by Henvey Inlet First Nation (through Nigig Power Corp.), which would maximize the aboriginal adder at another $15/MWh.

3680E78B8D

ReplyDeletehacker arıyorum

hacker kiralama

tütün dünyası

-

-

13B1D5F64F

ReplyDeletehacker bulma

hacker bulma

tütün dünyası

-

-

913DC2FE18

ReplyDeleteBeğeni Satın Al

Bot Takipçi

Tiktok Takipçi Atma

A3D092C091

ReplyDeleteWhen exploring options for high-quality printing solutions, many professionals turn to best dtf transfers to ensure vibrant and durable results. These transfers are known for their ease of use and excellent detail reproduction, making them a popular choice in the industry. For those seeking reliable and efficient methods, the availability of best dtf transfers can significantly enhance production quality. Overall, choosing the right transfer can make all the difference in achieving professional-grade prints.