Their plan restricts the ability of the province to efficiently minimize greenhouse gas emissions.

The three aspects of the Alberta's "Climate Leadership Plan" most relevant to the electricity sector are:

- implementing a new carbon price on greenhouse gas emissions

- ending pollution from coal-generated electricity by 2030

- developing more renewable energy

I've seen my province - Ontario - cited as an impediment to growing renewable energy in Alberta. This is understandable from a cost perspective, but if reducing emissions were the primary goal Ontario's example would be encouraging, as its emissions from generating electricity are a fraction of Alberta's.

I realize most Albertans are not awaiting opinions from Ontario, but I'll trust my analysis will be of interest to some in Alberta, and some elsewhere. Alberta is simply the sample case I'll use to argue specifically banning coal-fired electricity is unnecessary, and quotas for renewable sources to provide a fixed percentage of supply a little worse than that. This is not to argue for coal or little supply from renewables. Functionally, what I'll point to as better policy is likely to result in similar outcomes. I intend to demonstrate rules are being gamed to predetermine an unambitious outcome at the expense of achieving greater things.

I realize most Albertans are not awaiting opinions from Ontario, but I'll trust my analysis will be of interest to some in Alberta, and some elsewhere. Alberta is simply the sample case I'll use to argue specifically banning coal-fired electricity is unnecessary, and quotas for renewable sources to provide a fixed percentage of supply a little worse than that. This is not to argue for coal or little supply from renewables. Functionally, what I'll point to as better policy is likely to result in similar outcomes. I intend to demonstrate rules are being gamed to predetermine an unambitious outcome at the expense of achieving greater things.

A brief review of Albert's electricity system will be helpful prior to discussing the growth of renewables and elimination of coal.

|

| Figures are collected from AESO annual market statistic files (year 2013-2016) |

Available figures for Alberta's electricity generation include the percentage of electricity produced by generation technology. Unfortunately some categories change in 2010, but whether 2016 is compared to 2010 (the earliest year of the current categories) or 2004, coal has lost the greatest market share, and it has lost it to wind (probably the greatest change since 2004, natural gas (Combined Cycle gas turbines had the biggest 2010-2016 growth) and "Cogen" (for co-generation). Coal does continue to have 60% market share by this measure, so adding renewables until they have a 30% share seems doable - but it's more difficult depending on the definition of the market.

Different figures reported in Alberta's system can be largely reconciled by understanding the difference between Alberta Internal Load (AIL) and the generation required to meet load on the transmission grid (Tx). AIL is defined by the system operator, in a recent Long-Term Outlook (AESO 2017LTO), as:

The total electricity consumption within the province of Alberta, including behind-the-fence (BTF) load, the City of Medicine Hat and losses (transmission and distribution).This can be great information for reporting, but it is certainly far different information than measured in the above "percentage of metered volumes" chart. The most significant difference in generation when including self-generation, as shown in AIL figures, is the increased production attributed to cogeneration.

Getting to 30% of "Total Gross Generation", including all Alberta Internal Load, is a tougher nut to crack than getting to 30% of "metered volumes."

Co-generation is defined as, "The simultaneous production of electricity and another form of useful thermal energy used for industrial, commercial, heating or cooling purposes."(AESO 2017LTO) In Alberta it has been driven higher by the oil industry, which needs, "more heat than power, and it’s this heat that creates the surplus power potential that could be exported to the grid.” Co-generation is a very efficient use of natural gas, but all indications I've seen is it presents as baseload supply to the electricity grid, and if the heat client were to disappear, so too would the electricity supply (and demand). Therefore, I will prioritize the electricity system load over the Alberta Internal Load in my analysis. [1]

30% of AIL equates to 38% of the Alberta Electricity System Operator (AESO) system load. I am of the impression the target for renewables is 30% of AIL by 2030, but it's simply stated as "percentage of electricity." Functionally, a target of a percentage of AIL means that should oil sands operations grow, the electricity sector needs to grow the share of annual energy provided by renewable generators.

The industrial sector's impact on the electricity sector already results in Alberta's load profile being relatively flat: minimum annual system load is usually greater than 75% of the average load, and the annual peak not 30% above that average. A flat load profile would, historically, allow for more baseload generators, which are those designed to run continuously. Baseload generators are usually characterized as having high capital costs and low operating, including fuel, costs. Most generators will run more efficiently in baseload mode, and as more than 75% of annual Alberta load could be met by baseload generators, due to the load profile, it's not surprising coal presents itself as baseload supply there. That it has operated in baseload mode does not mean it must continue to do so.[2]

Alberta has been one of the purer electricity markets in North America. A pure market would rely on market pricing to incent new supply, or the contraction of supply. One way to categorize generators is as price-takers or price setters in the market. A quick way to see how a type of generation functions in a market is to measure value factors[2a] by dividing the average market value for that source, over a period of time, by the entire market's average over that time. A value factor of less than 1 indicates a source is a price taker, and above 1 indicates a price setter. A pure baseload supply would be less than 1, but if it provides other system functions (such as load balancing and ramping), they'll be close to 1.

In Alberta wind is obviously a price-taker, with gas, particularly single cycle, and imports, present as price-setters.[2b]

A decade ago electricity generators were categorized as baseload, intermediate, or peaking. Sporadic output from renewable sources, primarily wind and increasingly solar, have changed the categorization of generators. Conceptually there is now a tendency to separate energy, and capacity, values. Energy might be considered work volume, as measured in Watt-hours, and capacity as the ability to do that work when required - usually expressed in Watts. In the old paradigm most annual energy would be expected to come from baseload generators, and capacity would be supplemented by peaking resources. In modern Alberta, energy is planned to increasingly to come from renewable generators, and capacity from a separate process.

30% of Alberta’s electricity will come from renewable sources

Alberta's Climate Leadership Plan specifies 30% of electricity will come from renewable sources "such as wind and solar." The system operator, AESO, is now running procurement programs specifically for "renewables" as definined by Natural Resources Canada. Renewable sources include bioenergy and geothermal, but AESO Long-Term Outlook indicates they anticipate primarily wind with a much smaller component of solar.

The AESO's 2016 Annual Market Statistics show wind is often capable of generating only a small fraction of its nameplate capacity when Albertans' consumption is highest: during 2012's peak demand just 5%, in 2014 only 3%, and in 2015 only 7%.[3] The figures demonstrate Alberta wind has little capacity value, but a more rigorous analysis is needed to determine the implications of ramping up sporadic generation, such as wind, to 30% of electricity - which I suspect, due to self-generation, requires meeting 38% of system load.

The AESO's 2016 Annual Market Statistics show wind is often capable of generating only a small fraction of its nameplate capacity when Albertans' consumption is highest: during 2012's peak demand just 5%, in 2014 only 3%, and in 2015 only 7%.[3] The figures demonstrate Alberta wind has little capacity value, but a more rigorous analysis is needed to determine the implications of ramping up sporadic generation, such as wind, to 30% of electricity - which I suspect, due to self-generation, requires meeting 38% of system load.

To look at hourly wind production I've utilized data from the Pan Canadian Wind Integration Study (PCWIS).

Alberta is often noted as having a very strong wind resource, but that isn't indicated in the PCWIS data.

- The capacity factor is the annual output divided by the theoretical annual output if generating at 100% of nameplate capacity for all hours - Alberta has an average capacity factor

- The capacity value can be expressed as the percentage of nameplate capacity a system can rely on for meeting peak demand - Alberta's wind has the worst capacity value of any region in the PCWIS.[4]

The data work confirms the capacity value, as a percentage of rated capacity, is bad. My methodology for estimating capacity value is far simpler than the PCWIS modeling:

- subtract the wind output from load to calculate residual load

- subtract the residual load from the annual maximum load to get a capacity value

- divide the capacity value by the nameplate capacity.

Step 2 is a little more complicated as I take the third highest residual load of the year recognizing capacity values are based on loss of load expectations (LOLE). My figures are lower than the PCWIS; in both cases the capacity value is quite low for the initial (and actual) 5% Business-as-Usual scenario (5% BAU) but drop to extraordinarily low levels for incremental wind additions:

It is useful to know when the peak residual demand occurs. In all scenarios it occurs early winter evenings. This means the capacity value of solar will be nil. There can be no combination of wind and solar where the capacity value is not very small.

Thus the perceived need for a new capacity market. A broadcast criticism of capacity markets, which is also a whispered benefit, is that they provide a revenue stream for, to be blunt, old clunkers. The idea is that the older, usually dirtier plants, have higher fuel costs, and emissions, but it's far cheaper to run them a limited number of hours than to build a new plant - or pay a consumer not to consume.

Adding 30-40% of all annual generation from sources with little to no capacity value impacts the rest of the system very significantly. Combining the PCWIS 20% DIST scenario in Alberta, the system operator's (AESO) low load-growth scenario in the mid 2020's, and an assumption 1,200 megawatts of co-generation will be acting as baseload at that time, a look at some displays of hourly generation for some months indicates how the remainder of the system's generators would have to adopt generation patterns to match wind (and/or solar), but still exist.

In the 36 months modeled the one with the greatest share of load being met by wind is a November:

There's a surprisingly small amount of excess in this scenario, but only due to "baseload" generation being minimized in the scenario.

The month data indicates the lowest share of load would be met by wind is a July - which amply demonstrates that other generators need to be available when wind is not:

Proclaiming 30% of "Alberta's electricity" makes it difficult for any generator to operate in baseload mode - but to be sure the coal-fired generating stations operating mostly in that mode today cease generating altogether Alberta's Climate Leadership Plan also demands they cease to operate altogether by 2030.

Negative outcome of discouraging generators built to operate most of the time - the ones with higher capital costs and less fuel costs - are already revealing themselves. ATCO Power had planned to build two 400 MW CCGT units but "has decided not to proceed with the second." Capital Power and Enmax have approvals to proceed with two 530 MW units, but has deferred the projects, tacitly noting market structure uncertainty. Those 4 planned units would have doubled CCGT capacity in Alberta.

The uncertainty about the future on new CCGT facilities isn't solely due to the 30% renewable mandate.

Ending pollution from coal-generated electricity by 2030

Coal bans are increasingly popular - but not with me.Ontario eliminated coal in electricity generation early in 2014 - an effort that sprang from the report of an all-party committee back in 2002. Ontario imported coal, to fuel publicly owned generating stations, which made it well situated, politically, to end coal.[5] By 2012 the federal government, led by Calgary Conservative Stephen Harper, passed Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations (SOR/2012-167). Two criticisms of the legislation: many considered allowing existing plants a 50-year operating life too long, and specifying "Coal-fired" in regulations unnecessary in limiting emissions to 420 tonnes of CO2 equivalent per gigawatt-hour (420 t/GWh CO2e). Alberta later passed environment regulations plants would be required to meet after 40 years of operations, before the change in governing parties resulting in the current banishment.

Canada's current federal government has been mimicking Alberta policy. After the Alberta government announced a "carbon levy" the federal government announced everybody needs one; after Alberta announced coal was to be gone by 2030, so did the federal government - and the federal government addressed that 420 t/GWh CO2e when they did so. The new federal proposal is that all coal-fired generators now need to meet that standard by 2030, and so will new, large, gas-fired units - but small gas-fired units won't (they get 500 t/GWh limits), and most pertinently for Alberta, it's proposed that a unit converted from coal to natural gas can emit 550 t/GWh for an additional 15 years.

The failure to set a 40-year life has been expensive, with the Alberta government agreeing to pay off owners of generators entering service after 1980 to get their agreement to cease operation, on coal, by 2031. 79% of all Alberta coal-fired generating capacity will be over 40 years old by 2031. The promise of allowed higher emissions, and 15 more years of operating life, has led to all but 3 currently operating coal-fired units being cited as conversion prospects by their owners.

Gamed emissions standards are only one of the influencers of Alberta's electricity future.

The offer of 15 more years co-ordinates nicely with the capacity market mechanism, and 30% renewable requirement, to discourage more efficient new CCGT facilities - or even lower emission generators with cost structures demanding baseload operation.

The carbon levy will only apply to electricity emissions above the level of the most efficient large natural gas fueled powered plant (reportedly Shepard).

An Albertan carbon price/levy

I have called pricing carbon emissions a tool to heal and a tool to steal, and remain pro-carbon pricing in a cynical way.

I do not feel I am alone in cynicism. Banning coal strikes me as an example of a policy action taken precisely because of an assumption the carbon price will be ineffectual.

There are good reason carbon pricing would be too low to be particularly effective, and that is leakage - the movement of emissions, along with capital and jobs - to jurisdictions without carbon pricing. However, rooted in my mind is Clay Shirkey's tale of the daycare that introduced a small fine for late pick-up of children and subsequently saw a big increase in late pick-ups. Paying a little white carbon tax might make people more comfortable taking the extra flight for the extra vacation, adding the extra ton on the next extra big vehicle, accepting extra drive time to the next secondary residence, or emitting 50% more than necessary in generating electricity. A little white carbon price could allow people to claim they paid an appropriate price for their behaviour, without doing so.

Alberta's carbon levy on electricity is not a carbon price unless it's levied on a generator that doesn't emit more than the emissions limit for coal-fired power plants after 2030. Not only is the first approximately 420 tonnes from producing a gigawatt-hour to be free, when the carbon levy replaces the Specified Gas Emitters Regulation next January 1st, the fees due from generators for fueling a large combined cycle gas turbine (CCGT) will fall.

If the carbon levy grew to $50/tonne CO2e by 2022 - the carbon price the federal government is demanding - the actual tax on a coal generator refitted to burn gas, inefficiently, would be $6.5 per t CO2e.

And they get another 15 years of operation.

And revenue from a capacity market.

From 2006-2016 the share of Alberta's metered generation from coal-fired units fell 15%, with gas generator's share of the market rising over 7% and primarily gas-fired cogen rising 5.7%, and wind rising 5.6%. The ambitions of the Climate Leadership plan are limited to accelerating these trends.I do not feel I am alone in cynicism. Banning coal strikes me as an example of a policy action taken precisely because of an assumption the carbon price will be ineffectual.

There are good reason carbon pricing would be too low to be particularly effective, and that is leakage - the movement of emissions, along with capital and jobs - to jurisdictions without carbon pricing. However, rooted in my mind is Clay Shirkey's tale of the daycare that introduced a small fine for late pick-up of children and subsequently saw a big increase in late pick-ups. Paying a little white carbon tax might make people more comfortable taking the extra flight for the extra vacation, adding the extra ton on the next extra big vehicle, accepting extra drive time to the next secondary residence, or emitting 50% more than necessary in generating electricity. A little white carbon price could allow people to claim they paid an appropriate price for their behaviour, without doing so.

... a carbon levy is charged on all fuels that emit greenhouse gas emissions when combusted at a rate of $20/tonne in 2017 and $30/tonne in 2018. -AB gov'tbut...

Alberta's carbon levy on electricity is not a carbon price unless it's levied on a generator that doesn't emit more than the emissions limit for coal-fired power plants after 2030. Not only is the first approximately 420 tonnes from producing a gigawatt-hour to be free, when the carbon levy replaces the Specified Gas Emitters Regulation next January 1st, the fees due from generators for fueling a large combined cycle gas turbine (CCGT) will fall.

If the carbon levy grew to $50/tonne CO2e by 2022 - the carbon price the federal government is demanding - the actual tax on a coal generator refitted to burn gas, inefficiently, would be $6.5 per t CO2e.

And they get another 15 years of operation.

And revenue from a capacity market.

the manufactured outcome

2018 is likely to see a sharp drop in coal-fired generation, as a $30/t CO2e levy will apply to approximately 60% of their emissions, which should allow gas-fired generators to bid into the market at lower rates than coal. There will still be significant generation from coal as it currently has over the twice the capacity of gas generators (CCGT and SCGT). Beyond 2018 it's clear that as renewable generation capacity rises, capacity factors for generators throughout the system will drop.

The coal ban is unnecessary because rigorous emissions standards alone would end coal - the only reason to ban coal specifically is to allow dirtier gas-fired generation to continue. Standards on emissions, and more rigorous life-limits would be far better policy than hating on sedimentary rocks.

Alberta's 30% renewables quota is very similar to the 10,700 megawatt figure developed in Ontario by the Green Energy Act coalition in that it basically takes up all available minimum load space. It demands a level of sporadic generator that essentially blocks new baseload generators from developing. This policy connection between the provinces is not surprising as many of the same lobbyists, mislabeled as stakeholders, have been active in both.

Having limited the market for other generators, the capacity market currently being developed serves a similar function to the net revenue requirements (NRR) Ontario introduced, but much differently: NRR's contracted cleaner new generation on a longer term, whereas capacity markets are seen as allowing older units to remain in service despite lower utilization rates, with much shorter commitment periods.

Controlling the cost on other generators has been cited as a critical component of controlling costs as sporadic generation is added to a system. Alberta's policies due this through facilitating inefficient gas boilers. Another way to control cost would be through trade, but domestic requirements on the 30% renewables components discourages that.

conclusion

Challenges in decarbonizing globally don't involve simply 30% of electricity coming from renewable sources by 2030.I am among those who perceive clean baseload generators as by far the best route to low emissions. Ontario gets the majority of its generation from nuclear power, and the average intensity of emission from all electricity generation in this province are 1/10th of the level at which Alberta's generators' are exempted from paying its carbon levy.

Many oppose nuclear - some on price, some on fashion - so let's ignore it.

Some claim 100% renewables are possible, others seriously state the last 20% would be tough, but 80% is doable, but the world hasn't seen these things occur anywhere not blessed with plentiful falling water, so there is no template to follow.

It isn't obvious that Alberta's gamed system to get to 30% of supply is useful for getting to more ambitious market shares for renewables, or lower emissions levels.

It isn't obvious the gamed system is superior to simply an honest carbon price reflective of an honestly calculated social cost of carbon.

It isn't obvious dictating a quota for renewables is superior to dictating an overall level of allowable emissions.

It isn't obvious capacity should be procured separately from energy.

It isn't obvious the current government of Alberta isn't fighting yesterday's wars.

The question people are starting to grapple with is what other things have to happen to allow renewables to grow - in terms of technologies facilitating more sporadic generation being developed to improve flexibility, storage, and transmission. The systemic needs of a system with cheap renewable power are a bigger concern than how many wind turbines it's possible to spread.

I am skeptical that coal bans, 30% renewable quotas, life extension of old fossil fuel units and little white carbon prices create a positive environment for the development of advances needed for deeper decarbonization.

Climate Leadership cannot look like Alberta's plan.

Addendum

In researching this post I collected locational data for generators reported on the Alberta Electricity System Operator (AESO), allowing them to be mapped in a Power BI reportI already had data for wind turbine locations in the Pan-Canadian Wind Integration Study (PCWIS), so I included a page/tab for the Alberta site data in that study, and a method to view the facilities in each of the 4 PCWIS scenarios.

Perhaps most interesting is the non-map aspect of the third page of this mapping exercise: Emissions at Sites Reporting. The AESO reporting has multiple units on some sites, so those units needed to be grouped to connect to data from the Government of Canada Greenhouse Gas Emissions Reporting Program (GHGRP). I believe I've done so (for all units with emissions above the threshold that requires reporting). I find this a fascinating method of viewing the history of emissions in Alberta's electricity sector, but also in the sectors which are providing electricity as co-generation.

The units are tonnes in that view. Note from 2005 to 2015 CO2equivalent emissions (from all greenhouse gases) declines slightly from 47,766 kt to 46,917 kt.

Page 102 of Canada—National Inventory Report 1990–2015—Part 3 shows similar figures for all electricity: 55,200 kt CO2e in 2005 and 49,000 kt in 2015. The total GWh in the NIR, filed with the UNFCC, are essentially "Implied System Load" - not the broader Alberta Internal Load (AIL) where most co-generation exists.

While that curiousity relates to what I wrote on Alberta, perhaps more interesting is the size of emissions from "Non-Conventional Oil Extraction" which show in my Power BI reporting only if there is electricity generation from those operation on the AESO system.

May 2020 Addendum

I have updated my data structure, and Power BI reporting, on Alberta.

I've left in the Pan-Canadian Wind Integration (PCWIS) page, which will not update.

The "Emissions at Sites Reporting" page connects directly to the latest data from the Canadian government, and should therefore update once a year (currently 2018 is last available data).

Other pages report on AESO data, and I hope to update that data once a week.

End-Notes

[1]. The main AESO data files I've used for analysing load are Hourly load data for years 2005 to 2015 and 2016 Hourly Load file. Each use the term "Implied System Load" for the metric I found most relevant - I will simply call it system load.

[2]. To demonstrate why Alberta's load seems remarkably flat to an Ontarian, I've graphed the annual maximum and minimum demands that must be met by Alberta's system operation (AESO) and Ontario's (IESO).

[2a]. Value Factor is a concept I borrow from Lion Hirth's The Market Value of Variable Renewables:The Effect of Solar and Wind Power Variability on their Relative Price -

Hirth, Lion (2013): “The Market Value of Variable Renewables”, Energy Policy 38, 218-236.

doi:10.1016/j.eneco.2013.02.004.

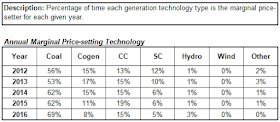

[2b] This concept of price-taker is related to the generator on the margin, which the AESO does report on as the "marginal price-setter", but, as Ontario often demonstrates, a price-taker can be the marginal price-setter. From the AESO's 2016 Annual Market Statistics Supplemental data file:

[3]. Table displayed in the Alberta Electricity System Operator 2016 Annual Market Statistics:

[4] The capacity factors for each region, and scenario, can be found in Table 4-12 on page 132 of the Pan-Canadian Wind Integration Study: capacity values are listed in Table 10-5 on page 343.

[5] Some material on Ontario's coal phase-out:

Jan Carr, former head of the Ontario Power Authority delivered a presentation, Ontario’s Coal Phase-Out, in Potsdam in November 2016.

DA7DB2431D

ReplyDeletekiralık hacker

hacker arıyorum

belek

kadriye

serik

3DA8DC29A0

ReplyDeleteTakipçi Satın Al

İzlenme Hilesi

Online Oyunlar